In the fast-paced world of cryptocurrency, staying informed and making informed decisions is crucial for both novice and seasoned traders. One of the most powerful tools at your disposal is crypto charts, which provide valuable insights into market trends, price movements, and potential future performance. Whether you’re a beginner or an experienced trader, understanding how to read and interpret these charts is essential for successful crypto trading. In this article, we will explore the fundamentals of crypto charts, key indicators to look for, and how to use them to maximize your trading strategy.

What Are Crypto Charts?

Crypto charts are graphical representations of the price movements and trading activity of a cryptocurrency over a specific period of time. These charts display the market’s historical performance, offering valuable insights into the behavior of the asset. By analyzing crypto charts, traders can identify patterns, trends, and potential turning points that may indicate opportunities to buy or sell.

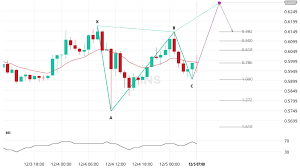

Crypto charts are typically presented in several forms, such as line charts, bar charts, and candlestick charts, with the latter being the most commonly used in cryptocurrency trading. Candlestick charts provide more detailed information, showing the opening, closing, high, and low prices for a specific time frame. This allows traders to gain a clearer picture of market sentiment and price action.

Key Components of Crypto Charts

- Time Frame: The time frame on a crypto chart refers to the duration for which price data is displayed. Time frames can range from minutes to days, weeks, months, or even years, depending on the trader’s needs and trading strategy. Shorter time frames are often used for day trading or scalping, while longer time frames are preferred for swing trading or long-term investments.

- Price Action: The price action on a crypto chart shows how the price of the asset changes over time. It forms the basis for technical analysis, where traders look for trends, support and resistance levels, and price patterns to make predictions about future price movements.

- Volume: Volume is an essential component of crypto charts, as it shows how much of a particular cryptocurrency is being traded within a specific time period. High trading volumes often indicate strong market interest and can be a sign of potential price movements.

- Support and Resistance Levels: Support levels represent the price point at which demand for a cryptocurrency is strong enough to prevent it from falling further. Resistance levels, on the other hand, are price points where selling pressure is strong enough to stop the price from rising. Identifying these levels is crucial for traders, as they can help predict price reversals or breakouts.

Common Types of Crypto Charts

- Line Charts: Line charts are the simplest type of crypto chart. They display the closing price of a cryptocurrency over a specified period, connecting the data points with a line. While line charts provide an easy-to-read overview of price movements, they lack the depth of information found in candlestick charts.

- Bar Charts: Bar charts offer more detailed information than line charts, showing the opening, closing, high, and low prices for each time period. This type of chart is often used to analyze daily or weekly price movements.

- Candlestick Charts: Candlestick charts are the most commonly used chart type in cryptocurrency trading. Each “candlestick” represents a specific time period (such as one hour or one day) and displays the opening, closing, high, and low prices for that time frame. Candlestick charts also use color coding to represent price movements, with green (or white) candles indicating a price increase and red (or black) candles indicating a price decrease. These charts are favored by traders for their ability to provide a comprehensive view of market sentiment and price action.

Key Indicators for Crypto Charts

To make informed trading decisions, traders often rely on various technical indicators to analyze crypto charts. These indicators help identify trends, momentum, volatility, and potential price reversal points. Some of the most commonly used indicators include:

- Moving Averages: Moving averages are used to smooth out price data and identify trends. The two most common types are the simple moving average (SMA) and the exponential moving average (EMA). Moving averages help traders identify whether an asset is in an uptrend, downtrend, or sideways movement.

- Relative Strength Index (RSI): The RSI is a momentum oscillator that measures the speed and change of price movements. It ranges from 0 to 100 and is used to identify overbought or oversold conditions. An RSI above 70 typically indicates that the cryptocurrency is overbought, while an RSI below 30 suggests that it is oversold.

- MACD (Moving Average Convergence Divergence): The MACD is a trend-following momentum indicator that shows the relationship between two moving averages. It helps traders identify bullish or bearish trends, potential reversals, and the strength of the trend.

- Bollinger Bands: Bollinger Bands are used to measure volatility and identify potential breakout points. The bands consist of a simple moving average (SMA) and two standard deviation lines above and below it. When the price moves close to the upper or lower band, it may indicate an overbought or oversold condition, signaling a potential reversal.

How to Use Crypto Charts Effectively

To use crypto charts effectively, it is essential to combine multiple indicators and chart patterns to form a comprehensive view of the market. Here are some tips for getting the most out of your crypto chart analysis:

- Start with the Basics: Begin by understanding the different chart types and time frames. Use candlestick charts to gain a deeper understanding of market sentiment and price action.

- Identify Trends: Look for patterns in price action to identify trends. Uptrends are characterized by higher highs and higher lows, while downtrends feature lower highs and lower lows. Recognizing trends can help you determine whether to buy, sell, or hold an asset.

- Use Technical Indicators: Utilize technical indicators like moving averages, RSI, and MACD to confirm your analysis and identify potential entry and exit points. These indicators can help validate price movements and provide insight into market momentum.

- Pay Attention to Volume: Volume is an essential indicator of market strength. A price movement accompanied by high volume is often more reliable than a movement with low volume. Always consider volume when analyzing price action.

- Set Stop-Loss and Take-Profit Levels: Crypto markets can be volatile, so it’s important to manage risk effectively. Set stop-loss orders to protect yourself from large losses and take-profit orders to lock in profits when a target price is reached.

Conclusion

Crypto charts are an indispensable tool for anyone involved in cryptocurrency trading. They provide essential insights into market trends, price movements, and trading volumes, helping traders make informed decisions. By understanding how to read and analyze crypto charts, utilizing key indicators, and combining technical analysis with sound risk management, traders can enhance their chances of success in the dynamic and volatile world of crypto markets. Remember, while charts are a valuable tool, they should always be used in conjunction with other forms of analysis and a well-thought-out trading strategy.

Leave A Reply