Tokenization is one of the most transformative concepts in the world of digital finance. As the world increasingly shifts towards blockchain and digital assets, tokenization is emerging as a powerful tool for reshaping how we view and interact with various types of assets. Whether it’s real estate, art, or even traditional currencies, tokenization is making it possible to break down large, illiquid assets into smaller, tradable units, opening up new opportunities for investors and businesses alike.

In this article, we will explore what tokenization is, how it works, its applications, and its potential to revolutionize the financial landscape.

What is Tokenization?

Tokenization refers to the process of converting real-world assets, such as real estate, stocks, bonds, or even intellectual property, into digital tokens that exist on a blockchain. These digital tokens are secure, transparent, and tradable, allowing investors to buy, sell, or transfer ownership in smaller, more accessible portions. Tokenization leverages blockchain technology to enhance the security, transparency, and efficiency of asset transactions.

The token represents ownership or a stake in the underlying asset, with the value and characteristics of the token tied directly to the asset it represents. For example, tokenized real estate could allow investors to own a fraction of a property rather than having to purchase the entire property, making it easier to diversify their investment portfolio.

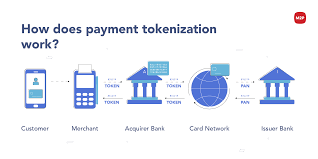

How Does Tokenization Work?

Tokenization works by creating a digital representation of a physical or intangible asset, which is then issued on a blockchain. The process typically involves the following steps:

- Asset Identification: The first step in tokenization is identifying the asset that will be tokenized. This can be anything from real estate, commodities, and stocks to more abstract items like art and intellectual property.

- Token Creation: Once the asset is identified, it is digitally represented as a token. This token is often issued on a blockchain, using a smart contract to define the rules, rights, and attributes of the token.

- Ownership Representation: Each token represents a fraction of ownership in the underlying asset. This could mean a specific percentage of a property, a certain amount of shares in a company, or a portion of an artwork.

- Trading: Tokenized assets can be traded on digital asset platforms, opening up new avenues for liquidity. Investors can buy, sell, or transfer ownership of the tokens, without the barriers traditionally associated with owning large assets.

- Security and Verification: Tokenization leverages blockchain’s decentralized nature to provide a high level of security. Ownership records, transaction histories, and asset details are recorded on the blockchain, making it easy to verify authenticity and ownership.

Benefits of Tokenization

Tokenization offers several advantages that make it appealing to both investors and businesses:

- Increased Liquidity: One of the biggest advantages of tokenization is its ability to unlock liquidity in traditionally illiquid markets. By breaking down large assets into smaller, tradable units, tokenization makes it easier for investors to buy and sell assets in smaller increments, without needing to purchase the entire asset.

- Fractional Ownership: Tokenization enables fractional ownership, allowing investors to own a piece of an asset rather than the whole thing. This is particularly beneficial for high-value assets such as real estate or art, which would otherwise be inaccessible to most investors due to their high cost.

- Global Accessibility: Blockchain technology, which underpins tokenization, is inherently global. Tokenized assets can be traded across borders, opening up new investment opportunities for people worldwide. This global reach helps democratize access to markets that were previously limited to wealthy individuals or institutional investors.

- Reduced Costs and Efficiency: Tokenization eliminates the need for intermediaries such as brokers, custodians, and banks, which typically add to the cost and complexity of asset transactions. The use of blockchain also reduces the time and cost of transferring assets by automating processes with smart contracts, making transactions faster and cheaper.

- Transparency and Security: Blockchain provides an immutable ledger, which means that all tokenized transactions are recorded and verifiable. This transparency reduces the risk of fraud and ensures that ownership rights are clearly defined and traceable.

Applications of Tokenization

Tokenization has a wide range of applications across various industries, some of the most notable include:

- Real Estate: Tokenization is revolutionizing the real estate market by making property ownership more accessible to a wider range of investors. Through tokenization, real estate can be divided into smaller units, allowing investors to purchase fractional ownership in properties, reducing the entry barrier for real estate investments. This also creates liquidity in a traditionally illiquid market.

- Financial Assets: Stocks, bonds, and other financial instruments can also be tokenized. Tokenization of financial assets makes trading simpler, faster, and more efficient, as tokens can be traded directly on blockchain platforms without the need for intermediaries.

- Art and Collectibles: High-value art and collectibles, which were previously inaccessible to most investors, can be tokenized, allowing individuals to buy fractional shares of valuable pieces. This not only opens up the art market to a broader audience but also enables more people to invest in art without needing to purchase an entire piece.

- Commodities: Tokenizing commodities such as gold, oil, or agricultural products allows for easier trading and fractional ownership, making it easier for smaller investors to participate in markets that were previously out of reach.

- Intellectual Property: Intellectual property rights, such as patents, trademarks, and copyrights, can be tokenized to make them easier to trade, license, or sell. This can help creators and inventors monetize their intellectual assets more efficiently.

Challenges and Considerations in Tokenization

While tokenization offers numerous benefits, there are also challenges and regulatory considerations that must be addressed:

- Regulatory Uncertainty: The regulatory landscape for tokenized assets is still developing, and many governments and regulators are working to establish clear guidelines for tokenization. Compliance with regulations is essential for ensuring that tokenized assets are legally recognized and traded in a secure environment.

- Market Volatility: Cryptocurrencies and tokenized assets are often subject to high volatility, which can create risks for investors. Price fluctuations can affect the value of tokenized assets, and investors must carefully manage these risks.

- Adoption and Education: Widespread adoption of tokenization depends on educating both investors and businesses about its benefits and how to use it. Building trust in the technology and ensuring that users have the necessary tools to participate is essential for the success of tokenization.

The Future of Tokenization

The potential of tokenization is immense. As blockchain technology continues to evolve and regulatory frameworks become clearer, the adoption of tokenized assets is expected to grow. Tokenization has the potential to transform industries, create new investment opportunities, and democratize access to wealth-generating assets.

Whether you’re an investor looking to diversify your portfolio, a business seeking liquidity, or a developer exploring new avenues, tokenization is poised to play a central role in the future of finance. By unlocking liquidity, enhancing accessibility, and reducing costs, tokenization could revolutionize the way we think about and interact with assets in the digital age.

Conclusion

Tokenization is reshaping the financial landscape by allowing real-world assets to be represented digitally on the blockchain. With its ability to unlock liquidity, enable fractional ownership, and provide a global market for assets, tokenization has the potential to democratize access to wealth-building opportunities. However, challenges such as regulatory uncertainty and market volatility must be addressed for tokenization to reach its full potential. As the world moves toward digital finance, tokenization is set to play an integral role in the future of investment and asset management.

Leave A Reply