In the rapidly evolving world of cryptocurrency, staking coins has emerged as a popular method for crypto enthusiasts to earn passive income. Staking involves locking up a certain amount of cryptocurrency in a network to support its operations, such as transaction validation or network security, and in return, participants receive rewards. This article provides a detailed exploration of staking coins, how it works, the benefits it offers, and the risks involved.

What is Staking Coins?

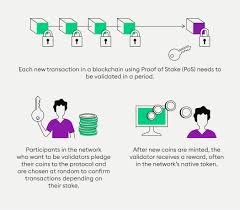

Staking coins refers to the process of holding and locking a specific amount of cryptocurrency in a digital wallet to support the operations of a blockchain network. The coins that are staked are used to secure the network, validate transactions, and contribute to the consensus mechanism of Proof of Stake (PoS) or similar blockchain protocols.

In return for staking their coins, participants are rewarded with additional coins, typically based on the amount of cryptocurrency they have staked and the length of time the coins are locked. This process of earning passive income has made staking an attractive option for long-term crypto holders.

How Does Staking Coins Work?

Staking is most commonly associated with blockchain networks that use a Proof of Stake (PoS) consensus mechanism, although other variations like Delegated Proof of Stake (DPoS) also exist. The general process of staking involves:

- Selecting a Staking Coin: Choose a cryptocurrency that supports staking. Popular staking coins include Ethereum (ETH), Cardano (ADA), Polkadot (DOT), and Solana (SOL). Each of these coins uses a PoS-based system to validate transactions.

- Staking the Coins: Once you’ve selected a coin, you’ll need to transfer it to a staking wallet or a staking platform. The coins are then locked for a certain period, during which they cannot be used for other purposes.

- Earning Rewards: In exchange for staking, you earn rewards, usually in the form of additional coins. The reward rate can vary based on factors such as the total amount of coins staked on the network, your coin holdings, and the duration for which you’ve staked your coins.

- Unstaking: After a predetermined period, you may choose to unstake your coins. However, some networks have a cooling-off period before you can access your staked funds.

Benefits of Staking Coins

1. Earn Passive Income

The primary advantage of staking coins is the opportunity to earn passive income. By simply holding and staking your crypto, you can earn additional tokens over time. These rewards accumulate as long as your coins remain staked, providing a steady stream of income without the need for active trading.

2. Support the Network

Staking is not only financially rewarding but also helps to secure the blockchain network. By staking coins, you are contributing to the network’s operation, helping to validate transactions and maintain decentralization. In a Proof of Stake system, stakers are responsible for verifying transactions and ensuring that the network operates smoothly, making the process an essential part of blockchain security.

3. Lower Energy Consumption

Compared to Proof of Work (PoW) systems like Bitcoin, staking coins in a PoS network is far more energy-efficient. PoW requires large amounts of computational power, leading to high energy consumption. In contrast, PoS-based systems, where coins are staked to validate transactions, consume much less energy, making them more sustainable in the long term.

4. Long-Term Holding Benefits

Staking coins encourages long-term holding, which can be beneficial for investors. By staking their assets, crypto holders are less likely to be swayed by short-term market fluctuations. This can help smooth out volatility and provide a more stable way to benefit from crypto investments over time.

Risks of Staking Coins

While staking coins offers significant rewards, it also comes with some risks. It’s essential to be aware of these potential downsides before getting involved in staking.

1. Lock-up Period

Most staking coins require participants to lock up their funds for a certain period. This means that you won’t be able to access your funds or sell your coins during the staking period. If the market experiences a sharp downturn, you may be unable to react quickly because your coins are “locked” in the staking process.

2. Validator Risk

In a PoS network, validators are chosen to propose and verify new blocks. If a validator acts maliciously or fails to properly validate transactions, the staked funds could be penalized or slashed. This is known as the “slashing” penalty. To mitigate this risk, it’s crucial to choose a reliable and reputable validator.

3. Network Risk

Staking coins also exposes you to the risk of network issues. If the blockchain network experiences bugs, vulnerabilities, or a security breach, staked coins could be at risk of being lost or stolen. It’s vital to ensure that the network you choose for staking has a robust security protocol in place.

4. Inflation of Coin Supply

When staking rewards are generated, they typically come from the inflation of the coin’s supply. If the rate of new coins being minted exceeds the demand for the cryptocurrency, the value of the staked coins could decrease over time. It’s essential to factor this risk into your decision-making process.

Popular Staking Coins

Several well-known cryptocurrencies offer staking opportunities. Some of the most popular staking coins include:

- Ethereum (ETH): Ethereum transitioned from Proof of Work to Proof of Stake with its Ethereum 2.0 upgrade, making it one of the largest PoS networks in existence.

- Cardano (ADA): Cardano is a prominent PoS-based blockchain that allows users to stake ADA tokens through a decentralized network of pools.

- Polkadot (DOT): Polkadot enables cross-chain interoperability, and its staking model allows users to participate in network governance and earn rewards.

- Solana (SOL): Solana offers high-speed transactions and a PoS-based consensus mechanism, making it an attractive option for staking.

Conclusion

Staking coins provides a unique opportunity for cryptocurrency holders to earn passive income while contributing to the security and decentralization of blockchain networks. With advantages such as passive income generation, lower energy consumption, and long-term holding benefits, staking has become an essential aspect of the cryptocurrency ecosystem. However, it’s crucial to weigh the potential risks, such as lock-up periods, validator issues, and network risks, before committing to staking.

If you’re looking to diversify your crypto portfolio and explore new ways of generating income, staking coins is an excellent option to consider. By selecting reliable staking platforms and understanding the mechanics behind staking, you can maximize your returns while contributing to the growth of the blockchain ecosystem.

Leave A Reply