In the fast-evolving blockchain landscape, Solana has emerged as a powerhouse, driven by its high-performance infrastructure and innovative token standard—SPL Token. As the native token protocol for Solana, SPL (Solana Program Library) Tokens are reshaping decentralized finance (DeFi), NFTs, and Web3 applications. This guide explores SPL Tokens’ technical depth, real-world use cases, and their pivotal role in Solana’s rise to become the second-largest DeFi network with $9.34 billion in total value locked (TVL) by 2025 .

What Are SPL Tokens?

SPL Tokens are fungible and non-fungible tokens built on Solana’s blockchain, governed by a standardized set of rules. Unlike Ethereum’s ERC-20 or Binance’s BEP-20, SPL Tokens leverage Solana’s Proof-of-History (PoH) and Proof-of-Stake (PoS) consensus mechanisms to achieve 65,000 transactions per second (TPS) at near-zero fees . This scalability enables seamless integration across DeFi platforms, NFT marketplaces, and gaming ecosystems.

Key Features

- Composability:

SPL Tokens reuse code templates, allowing developers to create new tokens efficiently. For example, the Token-2022 extension enhances functionality with features like transfer fees, interest-bearing tokens, and non-transferable tokens . - Interoperability:

SPL Tokens support both fungible (e.g., USDC-SPL) and non-fungible (NFT) assets under one standard, unlike Ethereum’s fragmented ERC-20/ERC-721 system . - Security:

Audited by firms like Halborn and Trail of Bits, SPL Tokens prioritize safety, with features like transfer hooks to enforce royalty payments and confidential transfers using zero-knowledge proofs .

Why SPL Tokens Matter for Developers and Investors

1. DeFi Dominance

Solana’s DeFi ecosystem has surged, driven by SPL Tokens. Platforms like Raydium and Serum facilitate high-speed decentralized trading, while Jito (a governance token) enables liquid staking . In 2024, Solana’s DEX volumes briefly surpassed Ethereum’s, thanks to SPL Tokens’ low fees and fast settlement .

2. NFT Innovation

SPL Tokens power Solana’s booming NFT market, where projects like Tensor and Tensorians generate millions in sales. The Token-2022 extension allows creators to enforce royalty payments automatically, addressing a critical pain point in Ethereum’s NFT space .

3. Enterprise Adoption

Enterprises are leveraging SPL Tokens for supply chain tracking, decentralized identity, and tokenized assets. For instance, Splinterlands uses SPL Tokens for in-game economies, while Magic Eden simplifies NFT minting for artists .

SPL vs. ERC-20: A Performance Showdown

| Feature | SPL Token | ERC-20 |

|---|---|---|

| Transactions/Sec | 65,000+ | 15–30 |

| Fees | $0.0002–$0.01 | $10–$50 (during congestion) |

| NFT Support | Single standard (SPL) | Multiple standards (ERC-721/1155) |

| Composability | Code reuse via Token-2022 | Limited flexibility |

This performance gap explains why Solana’s TVL grew 486% YoY in 2024, while Ethereum’s lagged at 12% .

Token-2022: The Future of SPL Tokens

Launched in 2023, Token-2022 is a game-changer for SPL Tokens. This extension introduces:

- Transfer Hooks: Automate actions during token transfers (e.g., royalties, taxes).

- Interest-Bearing Tokens: Represent bonds or yield-generating assets on-chain.

- Confidential Transfers: Use zero-knowledge proofs to hide transaction details.

- Non-Transferable Tokens: Ideal for loyalty programs or academic credentials .

Projects like Bonk Earn ($BERN) and Saga Genesis NFTs already use these features, showcasing SPL’s adaptability .

Solana’s 2025 Roadmap: Fueling SPL Growth

Solana’s 2025 upgrades aim to solidify SPL Tokens’ dominance:

- Firedancer: A new validator client that boosts throughput to 1 million TPS.

- Doubled Block Space: Expands network capacity to handle surges like the 2025 Trump/Melania meme coin frenzy .

- Institutional Adoption: Partnerships with firms like BlackRock and Coinbase are attracting $10B+ in institutional capital .

Analysts predict Solana’s market cap could reach $250 billion by 2025, driven by SPL Token adoption .

How to Get Started with SPL Tokens

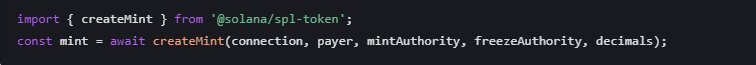

- Create a Token:

Use Solana’s CLI or tools like Spl Token to mint SPL Tokens. Example code:

(Source: )

- Trade on Exchanges:

Major platforms like Binance and FTX list SPL Tokens, while DEXs like Raydium offer decentralized trading. - Build on Solana:

Explore developer resources like Anchor (smart contract framework) and Metaplex (NFT ecosystem) .

Conclusion: SPL Tokens as Solana’s Growth Engine

SPL Tokens are the cornerstone of Solana’s ecosystem, enabling DeFi, NFT, and enterprise innovation at scale. With Token-2022 and Solana’s 2025 roadmap, SPL Tokens are poised to disrupt traditional finance and Web3.

Stay ahead of the curve with Bitora—your trusted source for Solana, SPL Token insights, and crypto market analysis.

Leave A Reply