In the rapidly evolving world of decentralized finance (DeFi), crypto borrowing has emerged as a powerful financial tool, enabling users to access liquidity without selling their crypto holdings. As the crypto market matures, more investors are exploring crypto borrowing to hedge investments, leverage assets, or avoid taxable events. But how exactly does crypto borrowing work, what are the benefits and risks, and how can you use it wisely? This article explores the ins and outs of crypto borrowing and how it’s reshaping modern financial strategies.

What Is Crypto Borrowing?

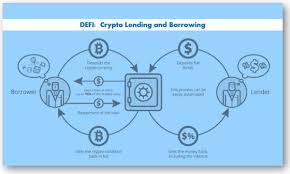

Crypto borrowing refers to the practice of using your cryptocurrency as collateral to take out a loan in either fiat currency or another cryptocurrency. It’s an alternative to selling your assets, allowing you to maintain exposure to the market while accessing funds for other purposes.

This system is facilitated by centralized platforms like BlockFi, Nexo, and Celsius, as well as decentralized lending protocols such as Aave, Compound, and MakerDAO. Users deposit crypto into a smart contract or custodial wallet, receive a loan based on a percentage of the asset’s value (typically 50–75%), and repay the loan over time with interest.

How Crypto Borrowing Works

- Deposit Collateral: You start by depositing a supported crypto asset (e.g., Bitcoin, Ethereum, or stablecoins) into a borrowing platform.

- Receive a Loan: Based on the Loan-to-Value (LTV) ratio, you receive a loan in fiat (USD, EUR) or crypto (USDT, DAI, etc.).

- Interest Accrual: The loan accrues interest, either fixed or variable, depending on the platform and market conditions.

- Repayment and Withdrawal: Once the loan and interest are repaid, your collateral is returned. If the collateral value drops below a threshold, liquidation may occur to cover the loan.

Benefits of Crypto Borrowing

1. Access Liquidity Without Selling

Investors who believe in the long-term value of their holdings can borrow against them instead of liquidating, preserving potential gains.

2. Avoid Capital Gains Tax

Selling crypto can trigger capital gains taxes in many jurisdictions. Borrowing lets you sidestep these taxable events, depending on your local regulations.

3. Leverage Investments

Borrowers can reinvest borrowed funds to amplify their exposure or participate in yield farming, although this comes with higher risk.

4. Financial Flexibility

Borrowed funds can be used for anything—business expenses, paying off high-interest debt, or even funding a real estate purchase.

Popular Platforms for Crypto Borrowing

- Aave: A decentralized protocol offering flash loans, stable and variable interest rates, and a wide selection of supported assets.

- Compound: A leading DeFi platform where users can supply and borrow assets, earning interest in COMP tokens.

- Nexo: A centralized lending platform with instant credit lines, daily interest payouts, and no credit checks.

- MakerDAO: The platform behind DAI, allowing users to lock up ETH and mint DAI as a stablecoin loan.

Each platform has different rules regarding LTV ratios, supported assets, interest rates, and liquidation protocols.

Risks and Considerations

1. Volatility and Liquidation

Crypto prices can drop rapidly. If your collateral’s value falls too far, the platform may liquidate it to recover the loan, often at unfavorable rates.

2. Smart Contract Risk

For DeFi protocols, smart contracts govern the system. Bugs or exploits could result in the loss of collateral or funds.

3. Centralized Custody Risk

Centralized platforms require you to trust them with your private keys and assets. Platform insolvency or regulatory action could lead to frozen or lost funds.

4. Over-Collateralization

Most platforms require you to deposit more value than you borrow (e.g., 150% of the loan amount), which can be capital-inefficient.

Crypto Borrowing vs. Traditional Loans

| Feature | Crypto Borrowing | Traditional Loans |

|---|---|---|

| Approval Process | No credit checks | Requires credit history |

| Speed | Near-instant | Days to weeks |

| Use of Collateral | Crypto assets | Real estate, cars, etc. |

| Regulatory Oversight | Limited (varies) | Strictly regulated |

| Flexibility | High | Moderate |

Crypto borrowing is especially appealing for those with significant digital assets but limited fiat liquidity, and for users in underbanked regions.

Who Should Use Crypto Borrowing?

- Long-term holders who want liquidity without selling.

- Crypto-native entrepreneurs seeking capital for startups.

- DeFi traders leveraging positions or arbitrage.

- Investors with tax sensitivity around asset sales.

However, it’s best suited for users who understand crypto market volatility, platform mechanics, and risk management.

The Future of Crypto Borrowing

With the rise of real-world asset tokenization, credit scoring for wallets, and multi-chain lending protocols, crypto borrowing is evolving rapidly. The future may include undercollateralized loans, peer-to-peer lending with reputation systems, and integration with traditional financial services.

As institutional interest in crypto grows and DeFi infrastructure matures, borrowing against crypto assets could become a mainstream financial strategy.

Conclusion

Crypto borrowing offers a compelling alternative to traditional finance, giving crypto holders the flexibility to access liquidity without selling their assets. It’s fast, decentralized (in many cases), and borderless. But it’s not without risks—from liquidation and smart contract vulnerabilities to custody concerns on centralized platforms.

For those who understand the landscape and practice sound risk management, crypto borrowing can be a powerful tool to unlock the full potential of digital wealth.

Leave A Reply