Crypto lending has become a prominent sector within the rapidly evolving cryptocurrency ecosystem. As decentralized finance (DeFi) continues to grow, crypto lending platforms provide investors with new ways to leverage their digital assets, offering opportunities for passive income and liquidity management. In this article, we will explore the concept of crypto lending, how it works, its benefits and risks, and the future potential of this emerging market.

What is Crypto Lending?

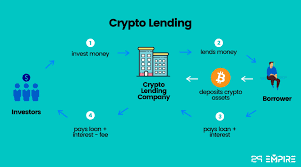

Crypto lending is the process of lending or borrowing digital currencies through platforms that connect borrowers with lenders. These platforms facilitate peer-to-peer lending, where lenders earn interest on the cryptocurrency they provide, and borrowers can access funds without going through traditional financial institutions.

In a typical crypto lending setup, lenders deposit their digital assets into a lending platform, which then lends out the assets to borrowers in exchange for interest. The terms of these loans can vary depending on the platform and the type of cryptocurrency being borrowed or lent.

Borrowers can use crypto lending to access loans without needing to sell their assets or undergo credit checks, which is particularly advantageous for those who wish to maintain exposure to the upside potential of their digital holdings.

How Crypto Lending Works

Crypto lending platforms generally operate in one of two ways: centralized or decentralized.

- Centralized Crypto Lending: Centralized platforms are run by organizations that manage the lending process and act as intermediaries between lenders and borrowers. Examples of centralized crypto lending platforms include BlockFi, Celsius Network, and Nexo. These platforms offer a variety of loan options and often allow users to earn interest on their deposited assets. Lenders earn interest from the borrowers who take out loans. The platform determines the interest rates based on supply and demand dynamics, similar to traditional banks, but the rates tend to be more attractive in the crypto lending space due to the high demand for loans. Borrowers typically provide collateral in the form of cryptocurrency, which the platform holds until the loan is repaid. If the borrower defaults, the platform liquidates the collateral to recover the loan amount.

- Decentralized Crypto Lending: Decentralized lending platforms, also known as DeFi lending, allow users to borrow and lend without an intermediary. These platforms operate through smart contracts on a blockchain, such as Ethereum or Binance Smart Chain. Examples of DeFi lending protocols include Aave, Compound, and MakerDAO. On decentralized platforms, users deposit their crypto assets into liquidity pools, where others can borrow from them. Interest rates are determined algorithmically, based on the demand and supply for a particular cryptocurrency. DeFi platforms typically offer greater privacy, transparency, and control to users since there is no central authority involved. The smart contract ensures that the terms of the loan, including the collateralization ratio and interest rates, are automatically executed, removing the need for third-party mediation.

Benefits of Crypto Lending

- Passive Income: One of the most attractive features of crypto lending is the ability to earn passive income. Lenders can earn interest on their digital assets, often at higher rates than traditional savings accounts or investment vehicles. Interest rates can vary widely based on the cryptocurrency being lent and the platform’s demand, but they typically range from 3% to 12% annually.

- Access to Liquidity Without Selling Assets: Crypto lending allows investors to access liquidity without selling their assets. For example, an investor holding Bitcoin or Ethereum can take out a loan using their digital assets as collateral, enabling them to access cash or other cryptocurrencies while maintaining exposure to the market’s potential upside.

- Increased Financial Inclusion: Crypto lending can provide financial services to people who may not have access to traditional banking systems. Since crypto lending platforms do not require a credit check, individuals in regions with underdeveloped financial infrastructure can access loans and earn interest on their digital assets.

- Diversification: Lenders can diversify their investment portfolios by lending different cryptocurrencies. With crypto lending platforms offering a variety of coins to lend or borrow, users have the opportunity to gain exposure to a broader range of digital assets, thereby reducing risks associated with holding a single asset.

Risks of Crypto Lending

- Default Risk: While lenders earn interest, there is a risk that borrowers may default on their loans. Although platforms usually require borrowers to provide collateral, the value of the collateral could drop significantly if the cryptocurrency market is volatile. In extreme cases, the collateral may not be enough to cover the loan.

- Platform Risk: Centralized platforms, in particular, carry risks related to platform security. If a platform is hacked or experiences a technical failure, users may lose their deposited funds. Additionally, centralized platforms are subject to regulatory oversight, which could impact their operations or lead to legal challenges.

- Volatility: Cryptocurrencies are highly volatile, and both lenders and borrowers are exposed to price fluctuations. A sudden drop in the price of the collateral could lead to a margin call or liquidation of the borrower’s assets. Similarly, lenders might find their returns eroded if the value of the digital asset they’ve lent declines sharply.

- Regulatory Uncertainty: The regulatory environment surrounding cryptocurrency lending is still evolving. While some jurisdictions have embraced crypto lending, others are taking a more cautious or restrictive approach. Future regulations could affect how lending platforms operate and the legality of offering loans in certain countries.

Future of Crypto Lending

The future of crypto lending looks promising as the DeFi ecosystem continues to expand. As blockchain technology matures, lending platforms are becoming more secure and efficient, offering better user experiences. Increased adoption of cryptocurrencies and growing interest from institutional investors will likely drive demand for crypto lending products.

Moreover, as decentralized platforms gain popularity, users will have more control over their assets, making crypto lending even more accessible and secure. Innovation in the space could lead to the development of new lending models, including flash loans, which allow users to borrow assets without collateral for very short periods, and staking-based lending, where staked assets can be used to access liquidity.

The development of regulatory frameworks will also play a key role in shaping the future of crypto lending. Clear regulations could provide greater security for users, encouraging wider adoption and attracting institutional investors.

Conclusion: Is Crypto Lending Right for You?

Crypto lending provides an attractive opportunity for cryptocurrency holders to earn passive income and access liquidity without selling their assets. While it offers several benefits, such as high-interest rates and increased financial inclusion, it is essential for participants to understand the risks involved, including default risk, platform security issues, and market volatility.

For those willing to do their research, choose reliable platforms, and carefully manage their risks, crypto lending can be a valuable addition to their investment strategy. Whether through centralized platforms or decentralized lending protocols, crypto lending is set to play a significant role in the future of the financial ecosystem, offering innovative solutions for both individuals and institutions alike.

Leave A Reply