When navigating the world of cryptocurrencies, one concept that often comes up is token supply. Whether you’re a new investor or a seasoned cryptocurrency enthusiast, understanding the impact of token supply on market value and asset prices is essential. Just like traditional markets where supply and demand influence prices, token supply plays a crucial role in the behavior of digital currencies.

In this article, we’ll dive into what token supply is, its various types, how it influences cryptocurrency values, and the factors you should consider when assessing token supply in your investment strategy.

What Is Token Supply?

In the cryptocurrency world, token supply refers to the total number of tokens or coins that exist for a particular cryptocurrency. These tokens can be used for various purposes, from serving as a store of value to facilitating transactions, governance, or staking within a blockchain ecosystem.

The token supply is a key factor in determining the market dynamics and potential growth of a cryptocurrency. In a simplified sense, token supply works similarly to how the supply of traditional assets, like stocks or commodities, impacts their market price. A higher supply typically leads to a lower price, assuming demand remains constant, and vice versa.

Types of Token Supply

Token supply can be broken down into several categories, each with its unique characteristics. These categories help investors assess the market potential and scarcity of a particular cryptocurrency:

1. Max Supply

Max supply refers to the total number of tokens that will ever be created for a particular cryptocurrency. This figure is fixed and predetermined by the creators of the token. For example, Bitcoin has a max supply of 21 million coins, meaning no more than 21 million Bitcoin will ever exist. The concept of max supply ensures that a cryptocurrency has a finite supply, which can contribute to scarcity and, potentially, its value over time.

2. Circulating Supply

Circulating supply is the number of tokens that are actively available and circulating in the market. These tokens are the ones that investors can buy, sell, or trade. The circulating supply is an important metric when evaluating the market capitalization of a cryptocurrency. Market cap is calculated by multiplying the circulating supply by the current token price.

3. Total Supply

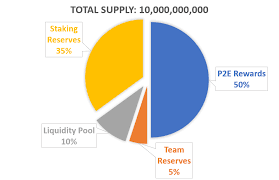

Total supply refers to the total number of tokens that are currently in existence, including those that are in circulation and those that are locked, reserved, or not yet mined. Total supply includes coins or tokens that are held back for various reasons, such as staking rewards, project development, or future distribution.

4. Inflationary vs. Deflationary Supply

Some tokens have an inflationary supply model, where new tokens are continuously generated, typically through mining or staking rewards. This model can lead to a constant increase in token supply, which may affect its long-term value. On the other hand, a deflationary token supply model involves a fixed or decreasing supply, which can create scarcity and potentially drive demand if the token gains popularity.

How Token Supply Affects Cryptocurrency Value

The impact of token supply on a cryptocurrency’s value is significant, and it operates in tandem with demand. To understand this, let’s look at a few key concepts:

1. Scarcity and Demand

In general, cryptocurrencies with a limited or fixed token supply can experience price increases as demand grows. Scarcity is a key economic principle that states that limited supply combined with increasing demand often leads to higher prices. Bitcoin is a prime example of this, as its max supply of 21 million coins has created a sense of scarcity, which has driven its value over the years.

For example, when Bitcoin’s supply becomes more scarce as it approaches its maximum supply, the price could theoretically rise if demand continues to increase. On the other hand, coins with unlimited or inflationary supplies may face downward price pressure if the market becomes saturated with tokens and demand does not match the increased supply.

2. Market Capitalization and Price Discovery

The circulating supply and token price directly contribute to the market capitalization (market cap) of a cryptocurrency. Market cap is an important metric for assessing the size and dominance of a cryptocurrency in the market. A cryptocurrency with a large circulating supply and a high token price can have a higher market cap, making it more appealing to institutional investors.

Market cap helps investors identify whether a coin is undervalued or overvalued based on its supply and price. However, investors should also take into account the total supply and max supply when analyzing the long-term value of a cryptocurrency. For instance, a coin with a low circulating supply and high demand may have more potential for price growth compared to a coin with an inflated supply.

3. Token Unlocking and Dilution

Another important factor to consider when evaluating token supply is the unlocking schedule. Many tokens are subject to lock-up periods, during which a portion of the supply is held back from circulation. Over time, as these locked tokens become available to the market, it can lead to inflation and price dilution.

For example, if a blockchain project or token creator has a substantial portion of the supply locked for a period of time, the market could experience price volatility once these tokens are unlocked and released into circulation. Investors should be aware of unlocking schedules as this could impact the supply-demand balance and the token’s value.

How to Assess Token Supply for Investment

When considering an investment in a cryptocurrency, it’s crucial to assess token supply alongside other metrics, such as the project’s use case, team, technology, and adoption. Here are some tips for evaluating token supply effectively:

- Understand the Supply Structure: Research the total supply, circulating supply, and max supply of a token. Look for clear details about how new tokens are created and whether the supply is inflationary or fixed. A clear and well-structured supply model often indicates a well-thought-out project.

- Consider Token Unlocking Schedules: Look into the unlocking schedule of any token and understand when a portion of the token supply will be released. If a large amount of tokens is locked and will be released into the market soon, it could cause price volatility.

- Evaluate Scarcity and Demand: Assess whether the cryptocurrency is scarce or has a limited supply. Scarcity combined with strong demand could indicate potential price growth in the future.

- Check the Tokenomics: Review the project’s tokenomics, which explains how the tokens are distributed, used, and governed. A sound tokenomics structure ensures that the cryptocurrency has long-term value and utility.

Conclusion: Token Supply’s Role in the Crypto Market

Token supply is a fundamental aspect of understanding cryptocurrency markets and investment opportunities. A cryptocurrency’s supply model—whether it’s limited or inflationary—plays a crucial role in determining its value, market dynamics, and potential for long-term growth. By carefully evaluating token supply alongside other critical factors like market cap, adoption, and project fundamentals, you can make informed decisions in the fast-paced and ever-changing world of digital assets.

As always, whether you’re a novice or an experienced investor, conducting thorough research and staying informed about the supply mechanisms of various cryptocurrencies is essential to success in the crypto space.

Leave A Reply