Introduction

In the fast-paced world of cryptocurrency, making informed investment decisions requires more than just following trends or news. Crypto analysis is a critical skill for anyone looking to navigate the volatile cryptocurrency market successfully. Whether you’re a beginner or an experienced investor, understanding the fundamentals and technical indicators of crypto analysis can help you make more calculated, less emotionally driven decisions.

This article will dive into the two main types of crypto analysis—fundamental analysis and technical analysis—and how you can apply these methods to evaluate cryptocurrencies and make well-informed decisions.

What is Crypto Analysis?

Crypto analysis refers to the process of evaluating cryptocurrencies to understand their potential as investments. The goal is to use various data points, indicators, and research to determine whether a particular cryptocurrency is likely to increase in value, remain stable, or decrease over time.

There are two main approaches to crypto analysis: fundamental analysis (FA) and technical analysis (TA).

1. Fundamental Analysis (FA)

Fundamental analysis involves assessing the intrinsic value of a cryptocurrency by looking at factors such as the project’s purpose, technology, team, market adoption, and broader economic factors. This type of analysis is more concerned with the long-term potential of a cryptocurrency rather than short-term price movements.

Key Elements of Fundamental Analysis in Crypto:

- Whitepaper: The whitepaper is a document that outlines the goals, technology, and mechanics of a cryptocurrency. A solid, well-written whitepaper can indicate a project’s credibility and long-term viability.

- Technology: Understanding the technology behind a cryptocurrency is crucial. For example, Ethereum has gained significant traction because of its smart contract capabilities, enabling decentralized applications (dApps) to function on its blockchain.

- Development Team: The experience, skills, and reputation of the project’s development team play a key role in determining whether a crypto project will succeed. High-profile developers or advisors associated with a project can indicate a higher chance of success.

- Adoption and Partnerships: Cryptocurrencies with real-world use cases and partnerships are more likely to see adoption. Look for collaborations with financial institutions, tech companies, or government entities that can help drive the adoption of a cryptocurrency.

- Market Sentiment: The general perception of a cryptocurrency in the market can provide insights into its potential. Sentiment analysis can help you gauge the emotional state of the market and anticipate price movements.

Applying Fundamental Analysis:

- Research the project’s roadmap: Look at upcoming updates and changes that could impact the cryptocurrency’s value.

- Evaluate tokenomics: Assess the supply, demand, and utility of the token. Is it inflationary or deflationary? How is it distributed?

- Check the community: A strong, active community indicates the project has a solid following and interest from users, which can lead to long-term growth.

2. Technical Analysis (TA)

Technical analysis is the study of price patterns, market trends, and trading volume to forecast future price movements. It is largely driven by historical data, chart patterns, and technical indicators. While fundamental analysis looks at the intrinsic value of a cryptocurrency, technical analysis focuses on market behavior and price action.

Key Elements of Technical Analysis in Crypto:

- Price Charts: Price charts are the cornerstone of technical analysis. By analyzing past price movements, traders attempt to predict future price trends. The most common types of charts are line charts, bar charts, and candlestick charts.

- Candlestick Patterns: Candlestick charts are used to identify price patterns that suggest future market movements. Common patterns include doji, hammer, bullish engulfing, and head and shoulders. These patterns can give traders insights into market sentiment and potential price reversals.

- Moving Averages: Moving averages (such as the 50-day and 200-day moving averages) help smooth out price data and identify trends. When the price crosses above or below a moving average, it can indicate a potential buy or sell signal.

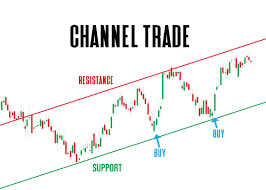

- Support and Resistance Levels: Support is the price level at which demand is strong enough to prevent the price from falling further, while resistance is the level at which selling pressure is strong enough to push the price back down. Identifying these levels helps traders understand where prices might reverse or break out.

- Volume: Trading volume is another key indicator in technical analysis. Higher volume typically indicates higher interest in a cryptocurrency, which can signify the strength of a price movement.

Applying Technical Analysis:

- Use indicators: Popular indicators include the Relative Strength Index (RSI), Moving Average Convergence Divergence (MACD), and Bollinger Bands, all of which help to identify overbought or oversold conditions in the market.

- Chart Patterns: Look for recurring chart patterns like triangles, flags, and head-and-shoulders to forecast price movements.

- Trendlines: Drawing trendlines on a price chart can help you understand the direction of the market and find entry or exit points.

3. Combining Fundamental and Technical Analysis

While both fundamental and technical analysis are useful on their own, combining the two can provide a more comprehensive view of the market. For example, if fundamental analysis shows that a cryptocurrency has strong long-term prospects, and technical analysis suggests a good entry point based on price patterns, the combination can offer a well-rounded investment decision.

How to Combine FA and TA:

- Use FA to find promising cryptocurrencies: Start by using fundamental analysis to identify cryptocurrencies with solid projects and growth potential.

- Use TA to time your entry and exit points: Once you’ve identified a cryptocurrency you believe in, use technical analysis to find the right time to buy or sell.

4. The Importance of Continuous Crypto Analysis

The cryptocurrency market is highly dynamic, and trends can shift rapidly. Regularly performing crypto analysis can help you stay ahead of market changes. Whether you’re holding long-term or engaging in day trading, staying informed allows you to make decisions based on the most up-to-date data available.

Tips for Effective Ongoing Crypto Analysis:

- Stay updated with market news: Follow reliable crypto news outlets to stay informed about technological advancements, regulatory changes, and market sentiment shifts.

- Track on-chain data: Monitoring metrics like wallet activity, transaction volume, and exchange flows can give you insights into investor behavior.

- Use crypto analysis tools: Platforms like TradingView, CoinMarketCap, and Glassnode offer valuable tools for both technical and fundamental analysis.

Conclusion

Mastering crypto analysis is essential for successful trading and investment in the cryptocurrency market. Whether you focus on fundamental analysis, examining the core aspects of a project, or technical analysis, studying price charts and market indicators, both methods offer valuable insights. By combining these approaches and staying updated with market developments, you can make more informed decisions, minimize risks, and maximize your potential returns.

Investing in cryptocurrency is not without its challenges, but with the right knowledge and strategies, crypto analysis can give you a significant advantage in navigating this exciting and volatile market.

Leave A Reply