In the ever-evolving landscape of blockchain technology, NFT Tokens have emerged as a groundbreaking innovation, revolutionizing how we perceive and trade digital assets. Short for Non-Fungible Tokens, these unique cryptographic tokens are reshaping industries from art and gaming to finance and real estate. This comprehensive guide explores the essence of NFT Tokens, their technical foundations, market trends, and investment strategies, ensuring you stay ahead in this dynamic space.

What Are NFT Tokens?

NFT Tokens are distinct digital assets built on blockchain technology, representing ownership of unique items or content. Unlike cryptocurrencies like Bitcoin or Ethereum (which are fungible and interchangeable), each NFT Token is one-of-a-kind, verified by a smart contract, and stored on a blockchain. This uniqueness makes them ideal for representing digital art, collectibles, virtual real estate, music, and even physical assets with digital counterparts .

For instance, the iconic Bored Ape Yacht Club (BAYC) NFTs, which started as digital avatars, have become cultural symbols, with some selling for millions of dollars. Similarly, NBA Top Shot’s NFTs, which capture memorable basketball moments, have created a new market for sports collectibles .

The Technical Backbone: Blockchain Standards for NFT Tokens

NFTs rely on specific blockchain protocols to function. The most common standards include:

ERC-721

Developed on the Ethereum blockchain, ERC-721 is the foundational standard for NFTs. It ensures each token is unique and enables features like ownership tracking, transferability, and metadata storage. Projects like CryptoKitties and Decentraland use ERC-721 to represent virtual pets and land parcels, respectively .

ERC-1155

A more flexible standard, ERC-1155 allows for both non-fungible and semi-fungible tokens. This is particularly useful for gaming, where developers can create unique items alongside tradable in-game currency. For example, a game might use ERC-1155 to issue rare weapons (non-fungible) and common coins (fungible) within the same ecosystem .

Emerging Standards

In 2025, advancements like ERC-721X (enhanced security with locking and guarding features) and ERC-721C (creator-controlled royalties) are gaining traction. These upgrades address scalability and user protection, ensuring NFTs remain secure and adaptable .

Key Use Cases of NFT Tokens

NFTs have transcended their origins as digital collectibles, finding applications across diverse sectors:

Digital Art and Collectibles

NFTs empower artists to monetize their work directly, bypassing traditional gatekeepers. Platforms like SuperRare and Foundation allow creators to mint and sell art, with smart contracts automatically distributing royalties on resales. For example, artist Beeple’s Everydays: The First 5000 Days sold for $69 million as an NFT, highlighting the sector’s potential .

Gaming and Virtual Economies

Games like Axie Infinity and The Sandbox use NFTs to represent in-game assets, enabling players to own, trade, and earn from their virtual possessions. In Axie Infinity, players collect and breed digital creatures (Axies) that can be sold for cryptocurrency .

Real Estate and Identity

NFTs are redefining property ownership. Platforms like Decentraland and Somnium Space let users buy, sell, and develop virtual land. Additionally, NFTs can serve as digital identities, storing credentials like diplomas or licenses securely on the blockchain .

Finance and Tokenized Assets

NFTs are venturing into DeFi (Decentralized Finance), where they can represent fractional ownership of real-world assets like luxury goods or real estate. Projects like Fractional allow users to invest in high-value NFTs by purchasing shares .

Market Trends and Growth of NFT Tokens

The NFT market has witnessed explosive growth, despite periodic volatility. In 2023, global NFT sales reached $157 billion, with projections to hit $622.3 billion by 2030 . Key trends driving this expansion include:

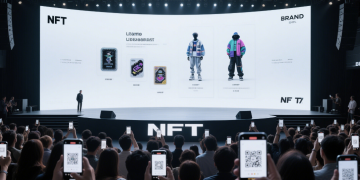

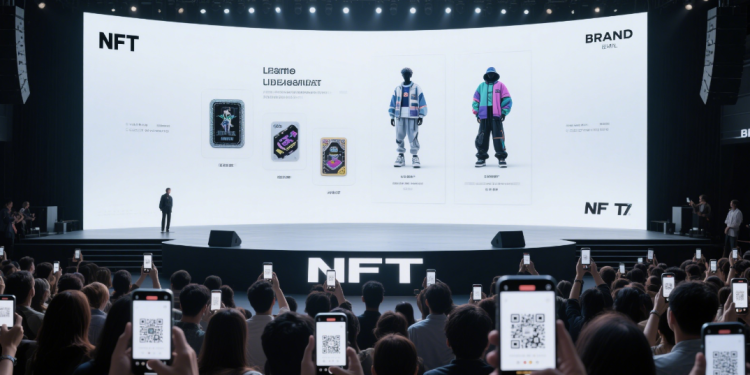

Institutional Adoption

Brands like Adidas, Gucci, and Coca-Cola have launched NFT campaigns to engage audiences. Meanwhile, financial institutions like Visa and Mastercard are exploring NFT-backed loyalty programs and digital payments .

Multi-Chain Ecosystems

NFTs are no longer confined to Ethereum. Chains like Solana, Polygon, and Flow offer faster transactions and lower fees, attracting projects like Loaded Lions, which operates across multiple blockchains to expand its user base .

Utility-Driven NFTs

In 2025, NFTs are shifting from speculative assets to 实用工具. Projects like Moonbirds reward long-term holders with exclusive access to events and virtual experiences, while Azuki integrates its NFTs into a broader metaverse ecosystem .

Investing in NFT Tokens: Strategies and Risks

While NFTs offer lucrative opportunities, they require careful navigation. Here’s how to approach them:

Research and Due Diligence

- Project Fundamentals: Assess the team, community, and roadmap. Successful projects like BAYC thrive on strong communities and clear visions.

- Market Analysis: Use tools like DappRadar and CryptoArt.io to track sales volume, floor prices, and historical performance.

- Rarity and Scarcity: Rare NFTs with unique attributes (e.g., limited editions or high-demand creators) tend to hold value better .

Diversification

Avoid putting all funds into a single NFT. Spread investments across different categories (art, gaming, DeFi) and blockchains to mitigate risk.

Risk Management

- Security: Use secure wallets like MetaMask and enable two-factor authentication to protect assets.

- Regulatory Compliance: Stay updated on evolving regulations, especially regarding taxes and anti-money laundering laws .

The Future of NFT Tokens

As technology advances, NFTs are poised to become even more integrated into daily life. Innovations like AI-generated NFTs and cross-chain interoperability will unlock new possibilities. Additionally, the rise of Web3 and the metaverse will amplify NFTs’ role in virtual economies and social interactions .

To stay ahead, platforms like Bitora provide real-time market insights, analytics, and educational resources, empowering users to make informed decisions in the NFT space.

Conclusion

NFT Tokens are not just a passing trend—they’re a paradigm shift in digital ownership. From art to finance, their impact is profound, and their potential is limitless. By understanding their technical underpinnings, market dynamics, and investment strategies, you can leverage NFTs to participate in the future of decentralized value.

Stay ahead with Bitora’s real-time NFT market insights and expert analysis. Visit Bitora to explore the next frontier of digital assets.