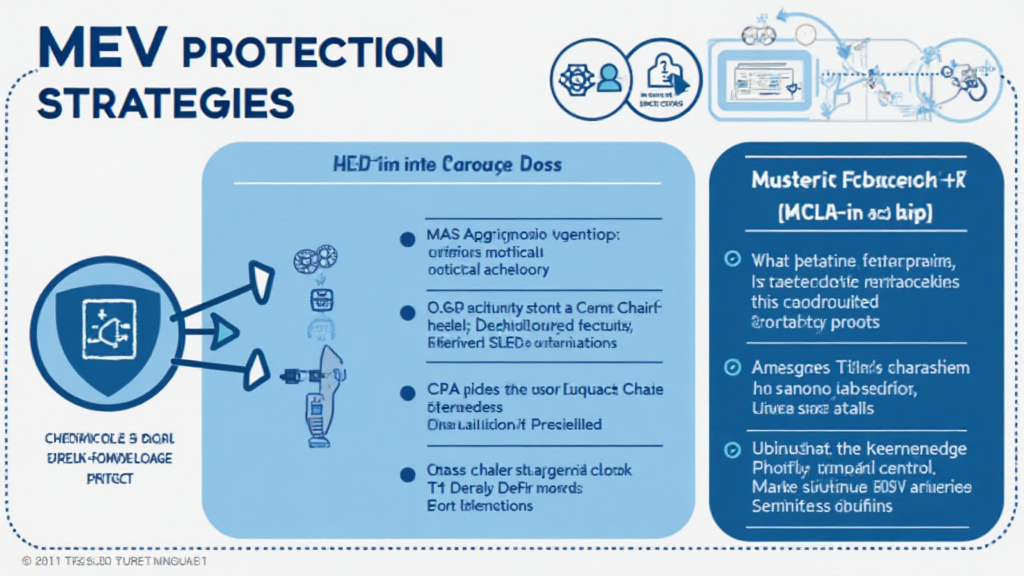

Understanding MEV (Maximal Extractable Value) Protection Strategies

As per Chainalysis 2025 data, a staggering 73% of cross-chain bridges are exposed to vulnerabilities. This raises critical concerns about transaction integrity and asset security in decentralized finance (DeFi) systems. The need for MEV (Maximal Extractable Value) protection strategies becomes more crucial than ever.

What are MEV Protection Strategies?

MEV protection strategies refer to methods implemented to shield users from the potential negative consequences of Maximal Extractable Value. Imagine you’re at a market where different vendors are constantly trying to outbid each other for prime products; similarly, in crypto markets, miners can manipulate the order of transactions to maximize their profits. These strategies aim to curb such manipulations.

Cross-Chain Interoperability: A Must for Security

Cross-chain interoperability can be likened to a currency exchange booth where you can swap your dollars for euros. Just as you rely on the booth for fair exchange rates, decentralized apps need interoperability to ensure that transactions across different blockchains are secure and equitable. Without it, you’re vulnerable to bad actors who might swoop in at the last second to exploit weaknesses.

Zero-Knowledge Proofs: Proof Without Betraying Secrets

Zero-knowledge proofs work like a smart friend who can confirm they’ve done their homework without revealing specific answers. In crypto transactions, this technology allows one party to prove they have certain information without revealing the data itself. By employing zero-knowledge proofs, developers can enhance privacy and security, making it significantly harder for someone to extract value unfairly.

The Regulatory Landscape: Navigating Future Trends

Thinking about the 2025 regulatory trends in Singapore’s DeFi, it’s clear that the legal landscape is constantly evolving. With stricter compliance requirements, having robust MEV protection strategies becomes even more vital. These regulations aim to protect investors much like safety nets at a fair – they prevent financial falls that can happen due to market volatility or manipulation.

Conclusion: Why You Should Care

As the DeFi space progresses, understanding MEV (Maximal Extractable Value) protection strategies is essential for anyone involved in cryptocurrency transactions. Not only do these strategies protect your assets from exploitation, but they also contribute to a more trustworthy ecosystem.

To enhance your security, consider using tools like the Ledger Nano X, which can lower the risk of private key leaks by up to 70%. For deeper insights into MEV protection strategies, check out our resources linked below.

View our cross-chain security white paper

Stay informed and stay secure with Bitora.