How to use HIBT for digital asset arbitrage: A Practical Guide

According to Chainalysis, as of 2025, a staggering 73% of cross-chain bridges contain vulnerabilities. In the rapidly evolving digital asset landscape, users face constant challenges related to interoperability and security. This guide will explore how to use HIBT effectively for digital asset arbitrage while addressing these pressing concerns.

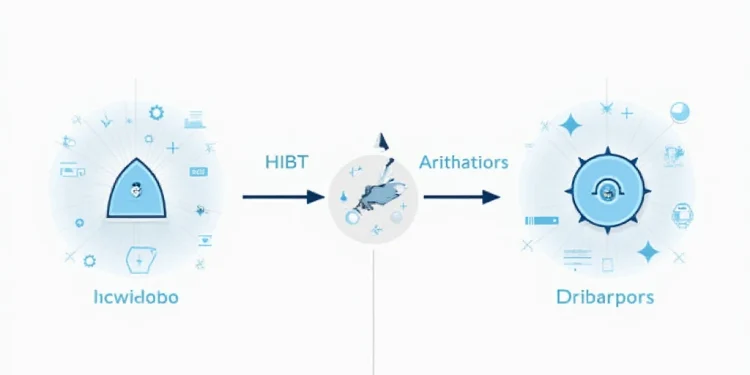

Understanding HIBT in the Digital Asset Landscape

HIBT, or Hybrid Interoperability Blockchain Technology, serves as a crucial tool for digital asset arbitrage. Think of it like a currency exchange booth at an airport. Just as different currencies can be exchanged conveniently, HIBT allows communication across various blockchain networks, enabling seamless asset trading.

How to Leverage Cross-Chain Interoperability

Cross-chain interoperability is vital for finding price discrepancies in digital assets. Imagine trying to buy oranges in one store and selling them for a higher price in another. HIBT facilitates this process by allowing traders to operate across different blockchains. When using HIBT, ensure to check market prices and choose the most profitable routes to maximize returns.

Implementing Zero-Knowledge Proof Applications

Zero-knowledge proofs (ZKPs) enhance security and privacy in transactions. Picture it like proving you have enough money to buy a car without showing your entire bank statement. By using ZKPs with HIBT, traders can execute arbitrage opportunities without exposing their transaction details, thus ensuring a safer trading experience.

Future Trends in Digital Asset Arbitrage

As we look towards 2025, the DeFi regulatory landscape in places like Singapore will likely impact how traders use HIBT. With evolving regulations, staying informed is crucial. Leverage tools like HIBT while remaining compliant with local laws to navigate the arbitrage landscape successfully.

In conclusion, understanding how to use HIBT for digital asset arbitrage is essential for traders looking to take advantage of market inefficiencies. For more insights, download our comprehensive toolkit that includes resources on safe trading practices and market analysis.

Check out our cross-chain security whitepaper for further reading.

Disclaimer: This article does not constitute investment advice. Before trading, consult with local regulatory authorities such as MAS or SEC.

Reduce your key exposure risk! Consider using the Ledger Nano X, which can lower private key leakage risks by 70%.