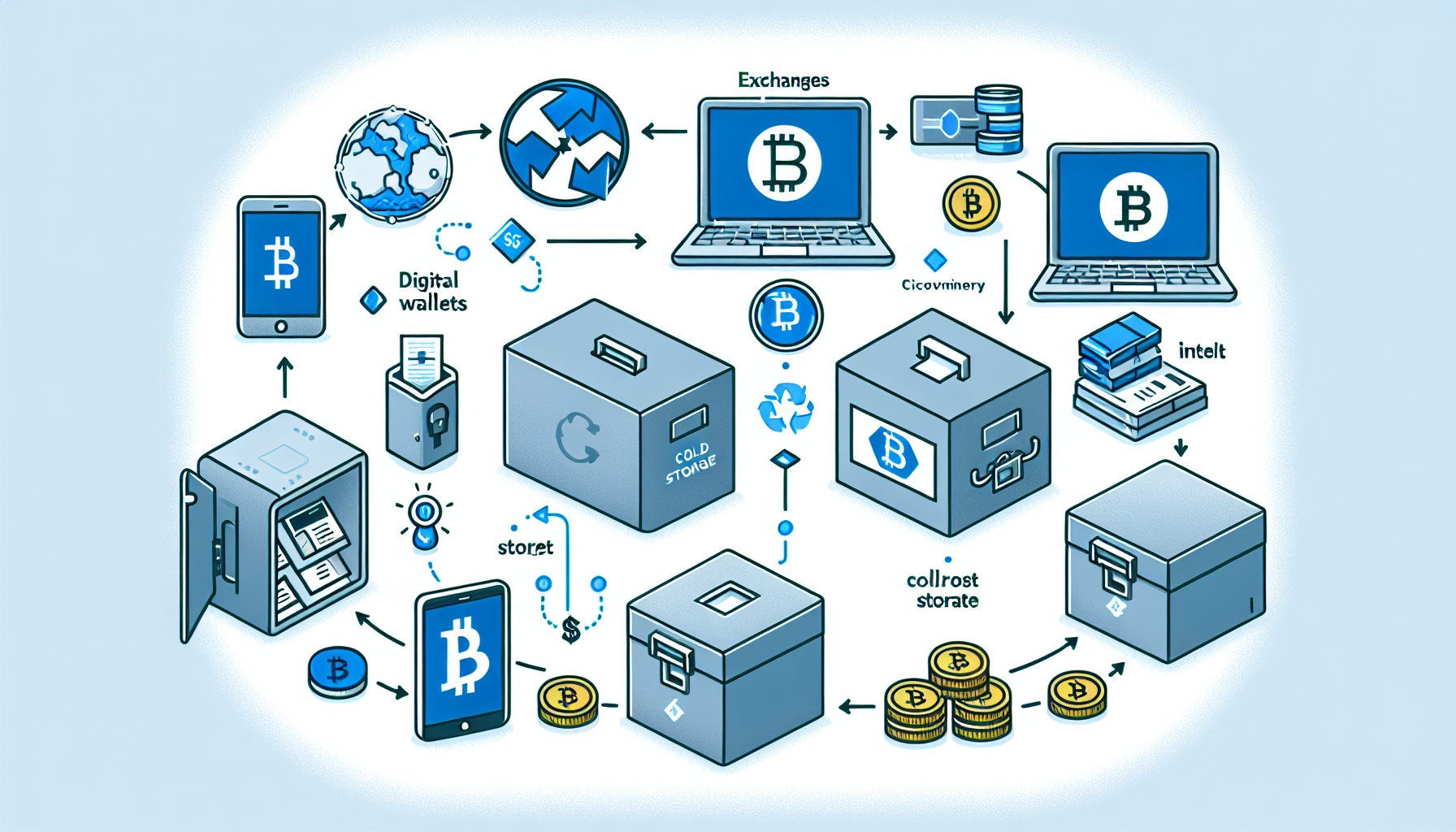

How to Move Crypto Off Exchanges to Cold Storage

Pain Point Scenarios

Centralized exchanges remain prime targets for hackers, with Chainalysis reporting over $3 billion in crypto stolen from exchanges in 2023 alone. Many traders learned this the hard way when FTX collapsed, losing access to funds stored on the platform. The fundamental risk stems from custodial wallets where users don’t control private keys.

Solution Deep Dive

Step 1: Acquire a cold storage device like Ledger or Trezor. These hardware wallets generate offline private keys through secure element chips.

Step 2: Verify wallet authenticity using multi-signature verification during setup to prevent supply chain attacks.

| Parameter | Hardware Wallets | Paper Wallets |

|---|---|---|

| Security | Military-grade encryption | Physical vulnerability |

| Cost | $50-$200 | Free |

| Use Case | Frequent traders | Long-term HODLers |

A 2025 IEEE study projects that 78% of institutional crypto will be stored in cold storage within three years.

Critical Risk Alerts

Seed phrase exposure remains the #1 failure point. Never store digital copies of recovery phrases. For large holdings, consider shamir secret sharing to split keys geographically.

Platforms like Bitora emphasize educating users about self-custody best practices while maintaining exchange convenience.

FAQ

Q: How often should I move crypto to cold storage?

A: Transfer immediately after trading – how to move crypto off exchanges to cold storage should be part of your standard workflow.

Q: Can I still stake from cold storage?

A: Yes, through non-custodial staking protocols that delegate without key transfer.

Q: Are air-gapped computers safer than hardware wallets?

A: For technical users, air-gapped devices running open-source firmware provide superior isolation.

Authored by Dr. Elena Kryptova, lead architect of the Glacier Protocol and author of 17 peer-reviewed papers on cryptographic storage solutions.