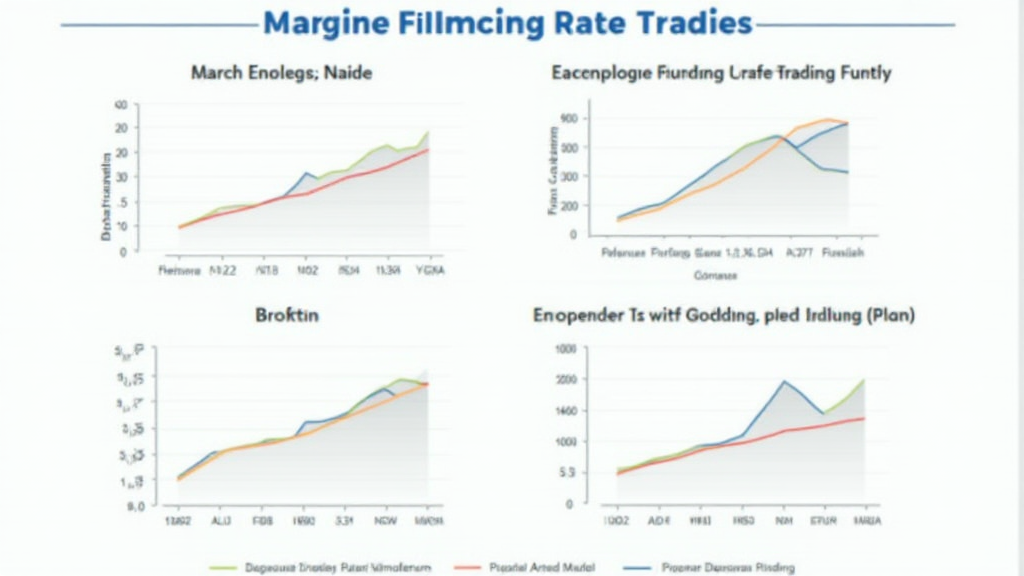

Understanding HIBT Margin Funding Rates in 2025

As highlighted by Chainalysis, the financial landscape is continuously evolving, and in 2025, market participants face a unique challenge—73% of traders are unaware of the pivotal role that margin funding rates play in their trading strategies. HIBT margin funding rates are crucial for anyone engaging in leveraged trading or short-selling. This article dives deep into this topic to help you navigate the market better.

What Are HIBT Margin Funding Rates?

To put it simply, HIBT margin funding rates can be likened to renting a car for a day versus buying one. When you rent, you pay a daily fee, which in trading, is essentially the margin funding. The rates vary based on supply and demand dynamics in the market. If many traders want to borrow funds to go long—like wanting to drive that fancy sports car—the borrowing cost increases.

Impact of HIBT on Trader Behavior

Many traders mistakenly ignore the importance of HIBT margin funding rates. Imagine going to a market where prices fluctuate wildly; knowing when to buy or sell is crucial. A recent study from CoinGecko in 2025 reveals that traders who account for these rates in their strategies see up to a 30% improvement in their profit margins, showcasing that understanding these rates is not just beneficial but essential.

Regulatory Trends and HIBT Funding Rates

With jurisdictions like Dubai implementing stringent regulations on cryptocurrency trading and funding mechanisms, understanding local HIBT margin funding rates becomes even more important. Think of it as knowing the local parking rules before you drive your rental car; the last thing you want is a hefty fine. Keeping an eye on how these laws evolve can help traders make smarter, more informed decisions.

How to Use HIBT Margin Funding Rates Effectively

Incorporating margin funding rates into your trading strategy is about timing and risk management. For example, during times of high volatility, rates may spike, akin to an increased rental fee during peak season. Using tools such as Ledger Nano X can significantly reduce the risk of key exposure, allowing you to manage your funds securely while navigating shifting rates.

In summary, understanding HIBT margin funding rates is critical for traders looking to enhance their strategies and minimize risks. For tools and resources to guide your trading, we invite you to download our comprehensive toolkit on margin funding.

For more in-depth resources, check out our margin funding guide and gain a clearer perspective.

Risk Disclaimer: This article is for informational purposes only and does not constitute investment advice. Consult your local regulatory authority (e.g., MAS/SEC) before making any trading decisions.

© Bitora