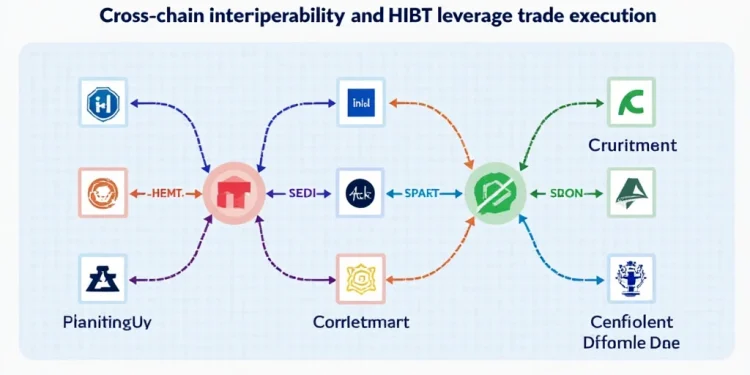

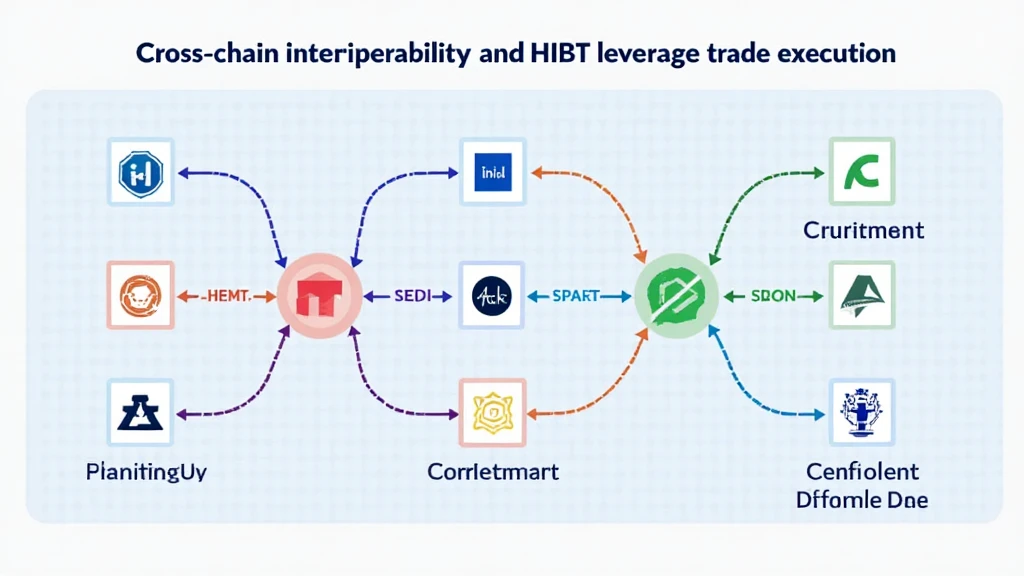

2025 Cross-Chain Interoperability Insights: HIBT Leverage Trade Execution

According to Chainalysis, by 2025, it is estimated that 73% of cross-chain bridges will harbor vulnerabilities. In an environment where digital assets are becoming increasingly interconnected, cross-chain interoperability is paramount. Investors and traders face challenges in executing leverage trades efficiently across different blockchains. Here, we explore key insights into HIBT leverage trade execution and how to navigate these challenges effectively.

Understanding Cross-Chain Interoperability

Think of cross-chain interoperability like a currency exchange kiosk in a bustling market. You have different currencies, and to buy a product, you need to convert them effectively. Similarly, in the crypto world, cross-chain interoperability enables seamless transitions between different blockchains. In 2025, we predict that traders using HIBT leverage trade execution will need to utilize efficient cross-chain services to maximize their returns.

The Role of Zero-Knowledge Proofs

Zero-knowledge proofs are crucial for maintaining privacy in transactions. Imagine telling a shopkeeper that you have enough money without revealing your exact balance. This is effectively what zero-knowledge proofs do in blockchain transactions. By leveraging these proofs, traders can ensure that their trades executed through HIBT will be both private and secure, a significant enhancement for executing leverage trades.

Insights on 2025’s DeFi Regulatory Trends

As the decentralized finance (DeFi) space expands, regulations are expected to evolve rapidly. For instance, Singapore’s regulatory bodies are actively drafting frameworks that will affect how HIBT leverage trade execution operates. This move can shape investor confidence and compliance, ultimately influencing market dynamics. Traders in regions like Dubai will need to stay updated with local cryptocurrency tax guides to avoid unexpected legal challenges.

Comparative Analysis of PoS Mechanism Energy Consumption

When considering blockchain technologies, energy consumption is a hot topic. If you compare it to driving a fuel-efficient car versus a gas guzzler, the choice you make impacts your wallet and the environment. Similarly, Proof of Stake (PoS) mechanisms offer a more energy-efficient alternative compared to Proof of Work (PoW). By leveraging the PoS mechanism, traders can execute HIBT leverage trades sustainably, attracting eco-conscious investors.

In summary, the future of leverage trade execution in crypto hinges on advancements in cross-chain interoperability, zero-knowledge proofs, regulatory trends, and sustainable energy practices. For detailed insights and crucial tools to enhance your trading strategies, [download our toolkit](https://hibt.com) now!