Introduction

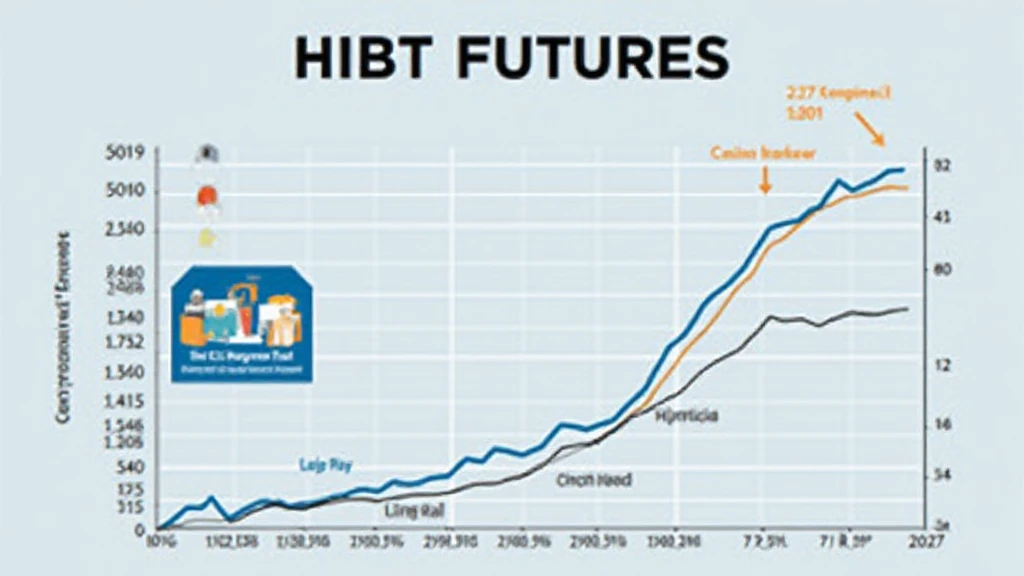

As we witness an unprecedented surge in cryptocurrency investments, the expiration of HIBT futures contracts has become a focal point for traders and investors alike. In 2024 alone, the crypto market lost approximately $4.1B due to various hacks, which heightens the importance of understanding futures contract mechanisms. This article delves into the critical aspects of HIBT futures contract expiration, providing insights essential for all market participants.

What is a Futures Contract?

A futures contract is a financial agreement to buy or sell an asset at a predetermined price on a specific date. Like storing valuables in a bank vault, futures contracts serve as a secure way to hedge or speculate on price movements. In the case of HIBT, understanding expiration dates becomes crucial.

The Mechanics of HIBT Futures Contract Expiration

When a HIBT futures contract nears its expiration, traders face a pivotal moment. They must decide whether to close their positions or roll them over into new contracts. Here’s why this matters:

- Market Volatility: As expiration dates approach, expect increased volatility.

- Liquidity Needs: Traders must manage liquidity effectively to avoid last-minute pitfalls.

According to Chainanalysis, market participation in Vietnam has seen a growth rate of over 25% in 2024, reflecting rising interest in tools like HIBT futures contracts.

Impact on Price Dynamics

Expiration can lead to significant price fluctuations for HIBT. Here’s the catch: as positions close en masse, there might be sharp movements in prices. Understanding when these expirations occur allows traders to strategize better, mitigating risks.

Tips for Managing HIBT Futures

1. **Keep Track of Expiration Dates:** Using a calendar can help you stay informed.

2. **Use Stop-Loss Orders:** This will protect your investments amid volatility.

3. **Educate Yourself:** Tools like HIBT’s trading tutorials can be invaluable.

Conclusion

In conclusion, grasping the nuances of HIBT futures contract expiration is vital in navigating the dynamic cryptocurrency landscape. With the market’s unpredictable nature, prepared traders stand to benefit significantly. As always, ensure to consult with local regulators regarding your trading strategies. Stay informed and ahead!