Introduction

In the evolving world of finance, a recent report from Chainalysis reveals that over 73% of real estate tokens are vulnerable. As regulations tighten, HIBT announces a compliance audit for real estate tokens, aiming to address these security gaps and provide a robust framework for investors.

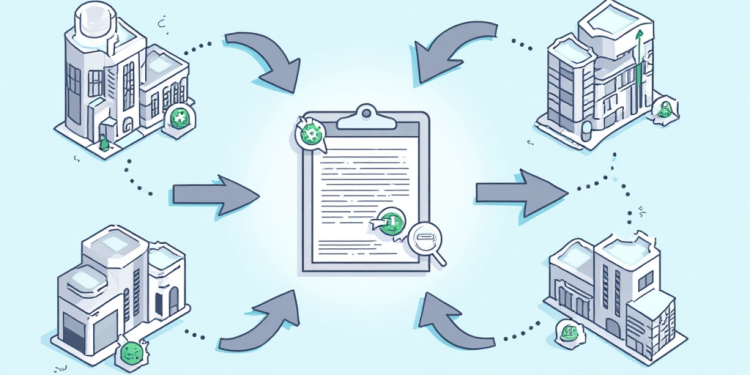

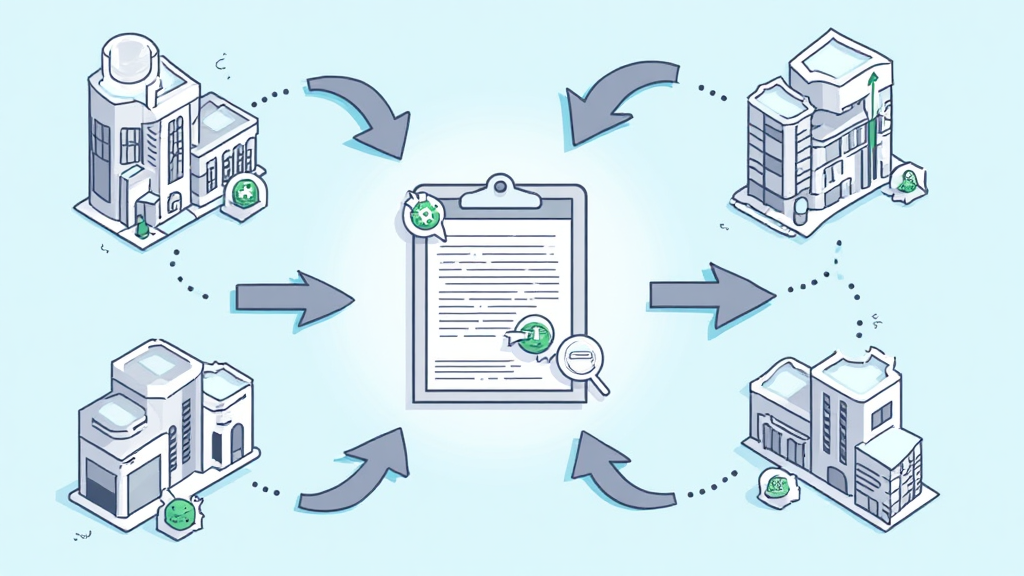

Understanding Compliance Audits

You might wonder what a compliance audit is, right? Think of it like checking a car before a long road trip. It ensures everything is functioning properly, so you don’t end up stranded. Similarly, HIBT’s compliance audit for real estate tokens will assess whether these tokens meet legal and operational standards.

The Importance of Real Estate Tokens

Real estate tokens are like ticket stubs for a concert; they represent your ownership in an asset. With HIBT’s compliance initiative, these tokens aim to provide a safer investment opportunity. As per CoinGecko data, real estate token investments are set to soar, but safety must come first!

Impact on Investors

Imagine you’re considering buying a pie. You want to know it’s fresh and worth the price, right? Similarly, HIBT’s compliance audit will serve to reassure investors that the underlying assets of real estate tokens are legitimate. This is crucial, especially with more people investing in 2025 regulatory frameworks for DeFi.

Conclusion

In summary, HIBT’s announcement for a compliance audit is a step toward securing the future of real estate tokens. Investors can feel more confident in their transactions as transparency becomes a standard. For a deeper understanding of compliance measures, download our comprehensive toolkit today!