Introduction

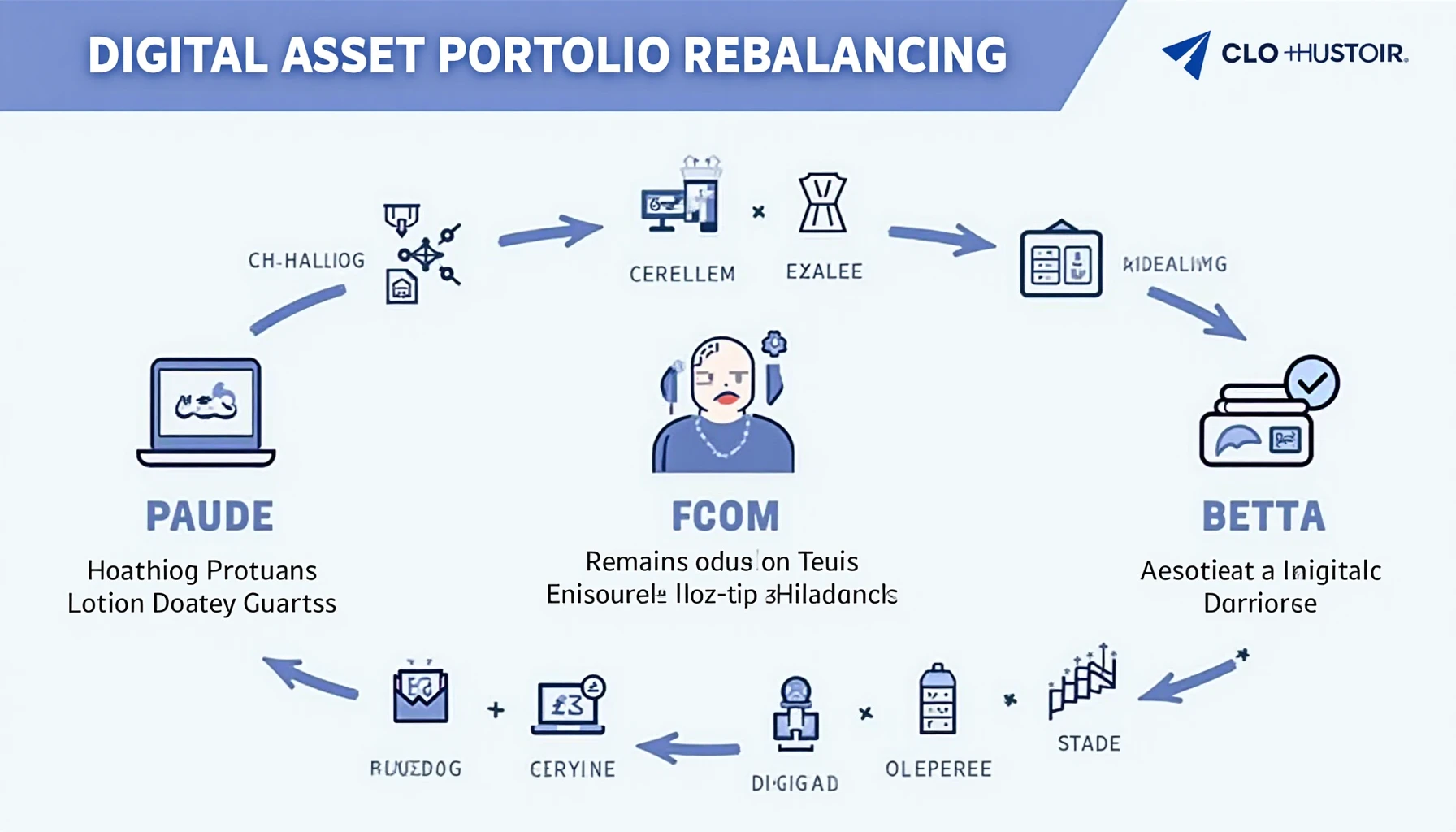

As the cryptocurrency market evolves, volatility remains a constant challenge for investors. Recent reports indicate that over $4.1 billion was lost to DeFi hacks in 2024 alone. With such staggering figures, learning about digital asset portfolio rebalancing tools is critical.

This article highlights the significance of portfolio rebalancing and introduces several effective tools that help investors maintain a balanced portfolio.

What is Portfolio Rebalancing?

Portfolio rebalancing involves adjusting the weight of assets within a portfolio to maintain a desired allocation. Think of it like a GPS recalculating your route; it ensures you stay on track toward your investment goals.

Benefits of Digital Asset Portfolio Rebalancing Tools

- Risk Management: These tools help in minimizing potential losses by ensuring proper exposure across different assets.

- Performance Optimization: Automated tools can identify profitable opportunities and allow for timely adjustments.

- Time Efficiency: Instead of manually tracking market conditions, investors can rely on tools for real-time monitoring and alerts.

Top Digital Asset Portfolio Rebalancing Tools

Here are some standout options in the market:

- Shrimpy: An easy-to-use platform that allows users to automate their portfolio management strategy.

- Altrady: Combines trading features with rebalancing tools to streamline cryptocurrency investments.

- BitPanda: Offers unique features tailored to European markets, particularly useful for Vietnamese users navigating the digital asset space.

The Vietnamese Market Perspective

Vietnam has seen a rise in cryptocurrency adoption, with a reported 120% user growth rate from 2023 to 2025. This growth emphasizes the need for robust digital asset management tools like the ones discussed.

Factors contributing to this growth include increased internet access and a young, tech-savvy population seeking investment avenues.

How to Choose the Right Tool for You

When selecting a portfolio rebalancing tool, consider the following:

- Your investment strategy: Are you a long-term holder or frequent trader?

- Ease of use: Look for intuitive interfaces to streamline your process.

- Integration: Ensure it connects with your preferred exchanges and wallets.

Conclusion

Using digital asset portfolio rebalancing tools is essential for anyone looking to navigate the cryptocurrency landscape effectively. Given the rapid changes in the market, these tools provide invaluable assistance in maintaining an optimal portfolio balance.

For more in-depth strategies on managing your digital assets effectively, check out hibt.com.

It’s important to highlight that this is not financial advice. Additionally, always consult local regulators before making significant investment decisions.

Stay updated on the latest trends and tools in the digital asset world with solutions that suit your unique needs. Remember, maintaining balance today may secure your success tomorrow!