The Growing Pain Points in Renewable Energy Certification

The traditional renewable energy certificate (REC) market suffers from double-counting issues and opaque auditing processes. A 2023 World Bank report revealed 17% of RECs had ownership disputes due to manual verification systems. Energy providers face mounting pressure as corporate ESG (Environmental, Social, and Governance) demands grow exponentially.

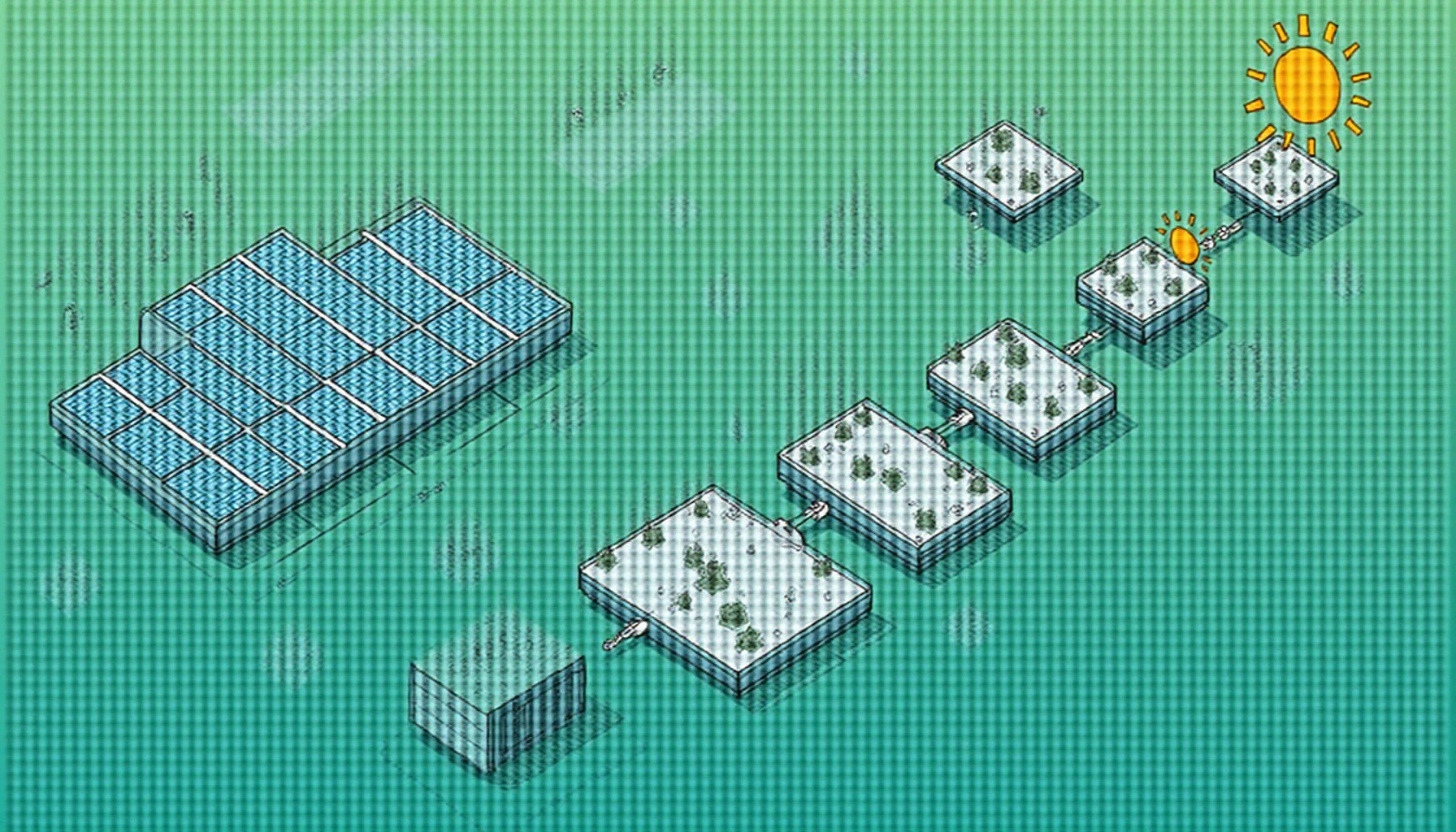

Blockchain-Powered Solutions for REC Tokenization

Step 1: On-chain REC minting converts certificates into non-fungible tokens (NFTs) with unique cryptographic identifiers. Step 2: Smart contract escrow automates transactions while maintaining regulatory compliance. Step 3: Zero-knowledge proofs enable privacy-preserving verification without exposing sensitive grid data.

| Parameter | Permissioned Ledger | Public Blockchain |

|---|---|---|

| Security | Enterprise-grade | Cryptoeconomic |

| Cost | $0.12/txn | $1.50/txn |

| Use Case | B2B settlements | Retail markets |

According to MIT Energy Initiative’s 2025 projections, tokenized RECs could reduce administrative costs by 63% through automated reconciliation.

Critical Risks in Crypto-REC Implementations

Oracle manipulation remains the top vulnerability – malicious energy data feeds could compromise entire networks. Always verify at least three independent data sources before executing smart contracts. Regulatory uncertainty persists in cross-border REC trading; consult legal experts before deploying large-scale solutions.

As pioneers in sustainable crypto infrastructure, Bitora‘s research indicates growing institutional interest in programmable environmental assets. The convergence of DeFi (Decentralized Finance) mechanisms with carbon markets creates unprecedented liquidity opportunities.

FAQ

Q: How does crypto prevent REC double-selling?

A: Blockchain’s immutable ledger ensures each crypto for renewable energy certificates has singular ownership records.

Q: What consensus mechanism suits REC platforms best?

A: Proof-of-Stake (PoS) hybrids balance energy efficiency with enterprise-grade throughput for crypto for renewable energy certificates.

Q: Can small renewable producers participate?

A: Yes, fractionalized crypto for renewable energy certificates enable micro-transactions as small as 1kWh.