Bitcoin Mining Difficulty Chart: Insights and Trends

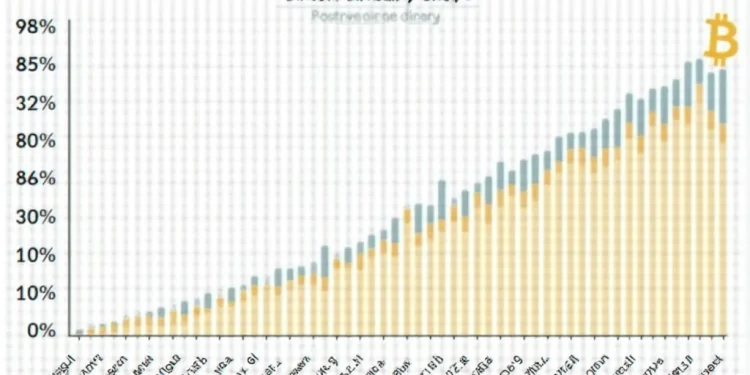

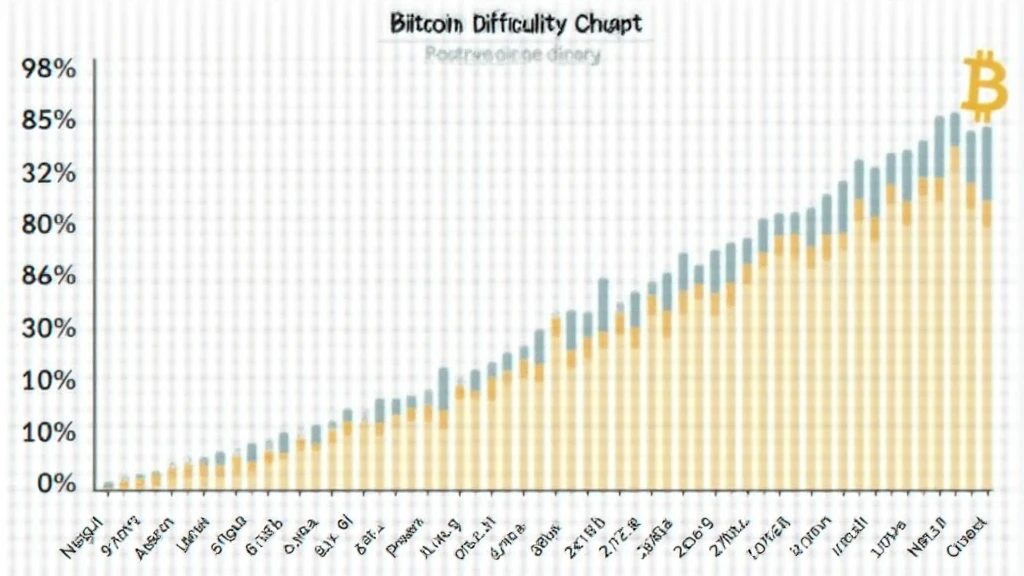

With the immense growth of cryptocurrency, understanding the Bitcoin mining difficulty chart has become crucial for miners and investors alike. In 2024 alone, Bitcoin reached unprecedented trading volumes, sparking a surge in competition among miners. But what exactly does the mining difficulty chart tell us about the current state of the market?

Understanding Bitcoin Mining Difficulty

Bitcoin mining difficulty refers to how hard it is to find a new block in the blockchain. It adjusts approximately every two weeks based on the network’s total computational power. Here’s how it breaks down:

- Higher difficulty: More miners are competing, indicating increased interest and potentially higher rewards.

- Lower difficulty: Fewer active miners may suggest market downturns or less profitability.

The Importance of Tracking Mining Difficulty

Monitoring the Bitcoin mining difficulty chart not only helps miners adapt their strategies but also allows investors to gauge market sentiment. For instance, in Vietnam, the growing number of Bitcoin users is influencing the mining landscape, resulting in shifting difficulties. According to recent statistics, Vietnam has seen a user growth rate of 30% over the past year.

Analyzing Historical Difficulty Trends

By examining past data from the Bitcoin mining difficulty chart, miners can identify patterns. As represented in the table below (Source: Blockchain.com), past performance shows how fluctuations in difficulty correlate with Bitcoin’s price:

| Date | Difficulty | Bitcoin Price |

|---|---|---|

| January 2023 | 35 T | $18,500 |

| July 2023 | 40 T | $25,000 |

| January 2024 | 45 T | $35,000 |

Future Projections and Market Adjustments

What should miners expect moving forward? The Bitcoin mining difficulty chart suggests several trends aligning with market performance. For 2025, blockchain experts predict an increase in mining difficulty as more miners join and Bitcoin adoption grows. This is where local insights, like understanding tiêu chuẩn an ninh blockchain, will play a significant role in ensuring safe and profitable operations.

Conclusion: Staying Ahead with the Bitcoin Mining Difficulty Chart

Keeping an eye on the Bitcoin mining difficulty chart can significantly impact mining strategies and investment decisions. As the Vietnamese market continues to expand, understanding these dynamics will be key for miners and investors alike. To stay updated on the latest trends, make sure to regularly check resources like hibt.com for insights and updates. Not financial advice. Consult local regulators.