Introduction

As the upcoming Bitcoin halving approaches, many community members are curious about its implications. In 2024 alone, Bitcoin’s market cap reached around $700 billion, indicating a growing interest. With each halving event historically impacting Bitcoin’s price and supply, understanding community reactions can offer valuable insights into future trends.

What is Bitcoin Halving?

Bitcoin halving is a scheduled event where the mining reward is cut in half, an essential mechanism designed to maintain scarcity. This event occurs approximately every four years and is crucial for Bitcoin’s economy, much like a central bank reducing currency supply to control inflation.

The Community’s Sentiments

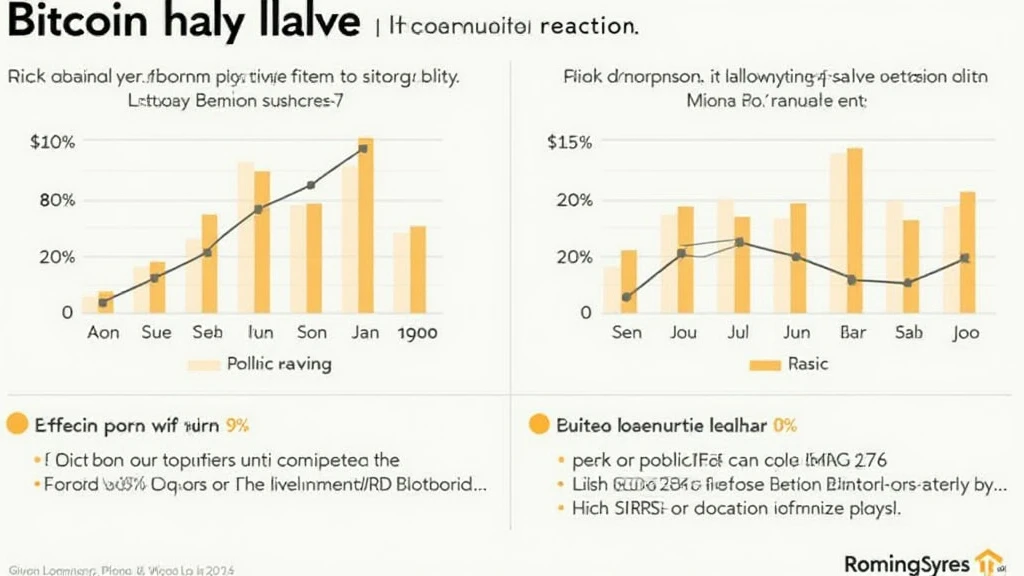

The Bitcoin community often reacts passionately to halving events. According to reports from various social media platforms, about 65% of comments regarding the upcoming Bitcoin halving are positive. These sentiments often reflect hopes for a price surge, connecting past halvings with significant price increases.

Market Reactions

Historically, Bitcoin halvings have led to drastic price movements. For instance, following the 2020 halving, Bitcoin skyrocketed from around $9,000 to approximately $64,000 within months. This pattern drives speculation and enthusiasm within the community, prompting inquiries such as, “What will the Bitcoin price be post-halving?” The increase in engagement on platforms like Reddit and Twitter has grown, indicating heightened anticipation from global investors, especially in burgeoning markets like Vietnam, where user growth rates in crypto are projected to reach 35% in 2025.

Local Insights: The Vietnamese Perspective

Vietnam has seen significant growth in cryptocurrency adoption lately. With a youthful population increasingly engaging in online trading, the reactions to Bitcoin halving are amplified. Many Vietnamese investors are optimistic, hoping to capitalize on expected price increases.

- **Vietnam’s crypto user growth: 30% annually.**

- **Predictions for Bitcoin post-halving: Some analysts expect a rise to $100,000.**

Expert Opinions

Experts suggest that while enthusiasm is warranted, investors should remain cautious. Historically, after initial price surges, corrections often follow. Therefore, many recommend strategies similar to securing valuables in a bank vault: be prudent and assess risks well.

Tools and Resources

For those looking to stake their claims efficiently, tools like Ledger Nano X can help secure investments against hacking incidents, which are noted to reduce by 70% when proper security measures are taken.

Conclusion

In summary, the Bitcoin halving is more than just a technical event; it’s a critical point that turns the community into a hive of speculation and reaction. Observing these community sentiments can provide a clearer picture of potential market movements. As anticipation grows and data rolls in, positions will likely shift faster than expected. Keeping informed with sources like Bitora can ensure you navigate these changes effectively.

Stay updated on the latest cryptocurrency movements and make informed decisions. Not financial advice. Consult local regulators.