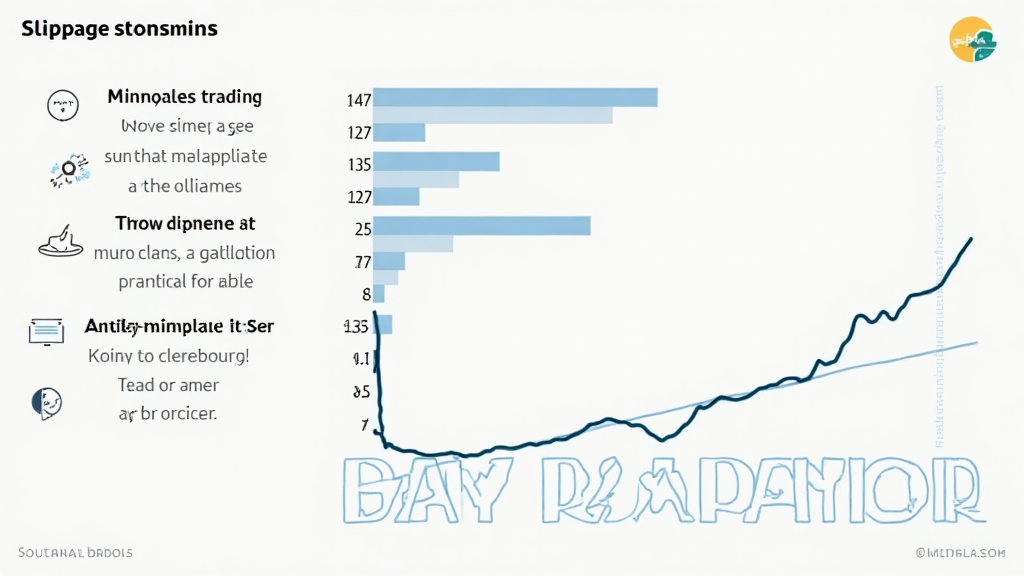

Understanding Slippage in Crypto Trading: A 2025 Guide

According to Chainalysis, slippage is a critical issue in crypto trading, with 73% of transactions experiencing some form of price discrepancy. This phenomenon can result in unexpected losses, especially in the volatile market that characterizes the cryptocurrency sphere. In this guide, we will explore what slippage is, how it works, and offer practical solutions for traders to navigate this challenge effectively.

What is Slippage and Why Should You Care?

Slippage refers to the difference between the expected price of a trade and the actual price. Imagine you’re at a bustling market trying to buy apples, and the price keeps changing before you can make a purchase. That’s slippage in action! In crypto trading, factors like high volatility and market depth can cause significant slippage, affecting your investment outcomes. Understanding this can help you make smarter trades!

How to Minimize Slippage in Your Trades

To reduce slippage, consider setting limit orders instead of market orders. A limit order allows you to specify the price at which you want to buy or sell, much like telling the vendor at the market, ‘I’ll buy these apples for $2 each, not a cent more!’ This way, you only buy at a price you’re comfortable with, potentially avoiding those unwanted surprises.

The Impact of Market Conditions on Slippage

Market conditions play a crucial role in determining slippage. During high-demand periods, such as when news of a popular cryptocurrency emerges, prices can fluctuate rapidly, leading to more slippage. It’s similar to having a sudden influx of customers at the market—prices may change before you can decide. Keeping an eye on market trends and using analytics tools can help you anticipate these shifts.

Investing in Tools to Control Slippage

Utilizing trading tools can significantly mitigate slippage. Tools like automated trading systems or slippage protectors can help ensure that your orders execute at the best possible price. Picture these tools as your personal traders, ensuring you don’t pay more for your apples than you planned. For instance, using Ledger Nano X not only protects your keys but also helps you make secure transactions, reducing your overall trading risk.

In conclusion, slippage is an unavoidable aspect of crypto trading that can lead to losses if not properly managed. By understanding the concept and employing various strategies to minimize it, traders can navigate the volatile waters of cryptocurrencies effectively. For more tips and tools on managing your trading risks, download our toolkit and stay ahead of the game.

Check out our research on crypto market volatility and learn more about securing your crypto assets.