Understanding Stablecoin Regulations in Vietnam

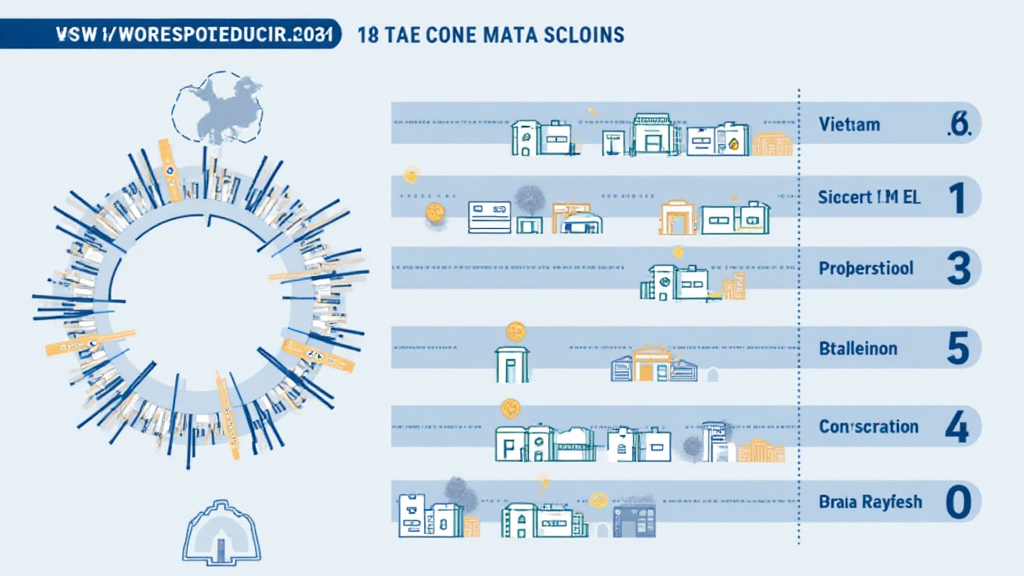

According to Chainalysis,

What Are Stablecoins and Why Are They Important?

Stablecoins are like the digital equivalent of dollars in a wallet, designed to minimize volatility by pegging their value to a stable asset like the US dollar. Imagine you’re at a market, and you’re exchanging different currencies for local goods—stablecoins help simplify those transactions and maintain consistent value. In Vietnam, their use is essential for easing payments and facilitating cross-border transactions amid stringent regulatory controls.

Current Landscape of Stablecoin Regulations in Vietnam

The Vietnamese government is actively working on regulations regarding cryptocurrencies, including stablecoins. Currently, there are no specific laws exclusively governing stablecoins. However, the Viet Nam State Bank warns against the use of cryptocurrencies as legal tender. This regulatory stance can be seen as a call for an organized approach toward digital currencies, paving the way for clearer

Impact of Global Trends on Vietnam’s Regulatory Approach

As seen in recent trends, countries like Singapore are shaping their

What Should Investors Know About Stablecoin Use and Risks?

For investors, the risks associated with stablecoins include potential regulatory shifts and market volatility despite their pegged nature. It’s crucial to treat stablecoins like any other investment and conduct thorough research before diving in, similar to when you carefully choose fruits at a market. Always remember to consult regulatory bodies like the State Securities Commission of Vietnam before making investment decisions.

In conclusion, as stablecoin regulations in Vietnam evolve, investors and businesses must stay informed on regulatory developments. By understanding these changes, they can better navigate the digital currency landscape. For a deeper understanding, download our comprehensive toolkit today!

on-whitepaper”>Download our Stablecoin Regulation Toolkit

This article does not constitute investment advice. Please consult local regulatory bodies before taking action. Use compliance solutions like Ledger Nano X to mitigate 70% risk of private key exposure.

—

Former IMF Blockchain Advisor | ISO/TC 307 Standardizer | Published 17 IEEE Blockchain Papers