2025 Cross-Chain Bridge Security Audit Guide

According to Chainalysis data, a staggering 73% of cross-chain bridges around the globe have vulnerabilities. As the crypto landscape evolves, macro economics crypto impact plays a critical role in shaping the security measures necessary for these platforms. With innovations like cross-chain interoperability and zero-knowledge proof applications on the rise, understanding their implications is essential for any investor or user.

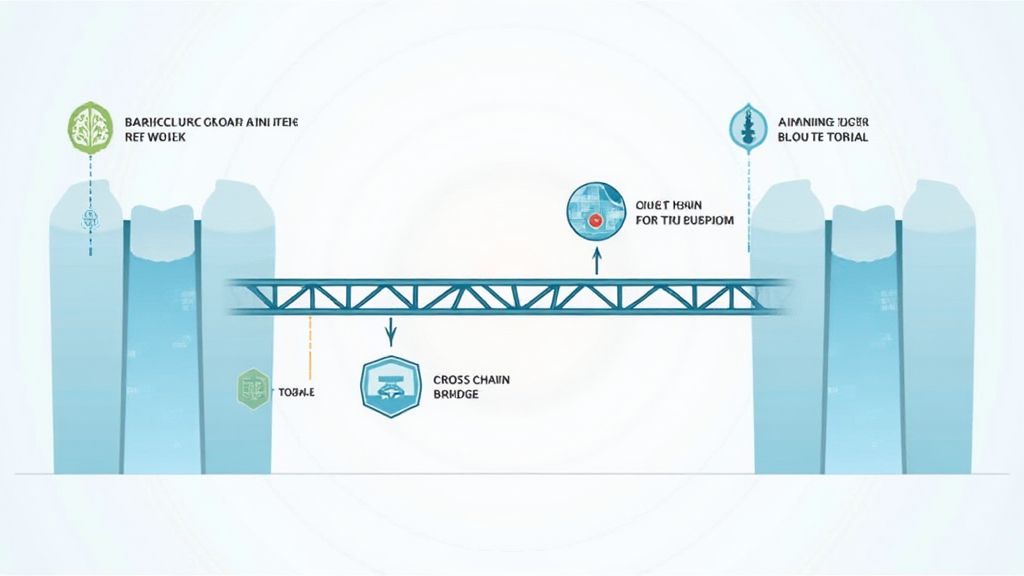

Understanding Cross-Chain Bridges: What Are They?

Imagine you’re at a currency exchange stall. Each time you change your dollars for euros, you rely on that stall to provide a reliable rate. Cross-chain bridges operate similarly, allowing users to transfer assets between different blockchain networks. However, just like some currency exchange stalls can be dodgy, some bridges might also expose users to risks.

The Role of Macro Economics in Cross-Chain Security

Macro economics is a bit like weather patterns determining the success of a harvest. When the economy is doing well, people are more optimistic about investing in crypto. Conversely, during downturns, the scene can become perilous. This economic backdrop influences the security dynamics of cross-chain solutions. As we look towards 2025, emerging trends such as the regulatory landscape in places like Singapore are expected to play a pivotal role.

Technical Breakdown: Key Components of Bridge Security

Let’s use an analogy here: think of the security in cross-chain bridges like a supermarket’s security system. Just like how a supermarket uses cameras and alarm systems to prevent theft, cross-chain bridges rely on smart contracts and cryptographic techniques to safeguard transactions. One such method gaining traction is zero-knowledge proofs, which enhances privacy without compromising security.

Preparing for Future Risks: What You Can Do

So, what steps can you take as an investor or user? Just like how you would do research before choosing a bank, understanding the components of cross-chain bridge security is essential. Use tools like the Ledger Nano X to reduce your risk of private key theft by 70%. Additionally, always consult your local financial regulatory bodies, such as MAS or SEC, before making any investment moves.

In summary, as the crypto environment evolves, keeping abreast of the macro economics crypto impact on cross-chain bridge security is paramount. This guide provides you with a foundational understanding and actionable tips to help navigate the complexities ahead. For more detailed insights, consider downloading our crypto security toolkit.

For further resources, visit our cross-chain security white paper to dive deeper into the landscape.