Introduction to HIBT: A Year in Review

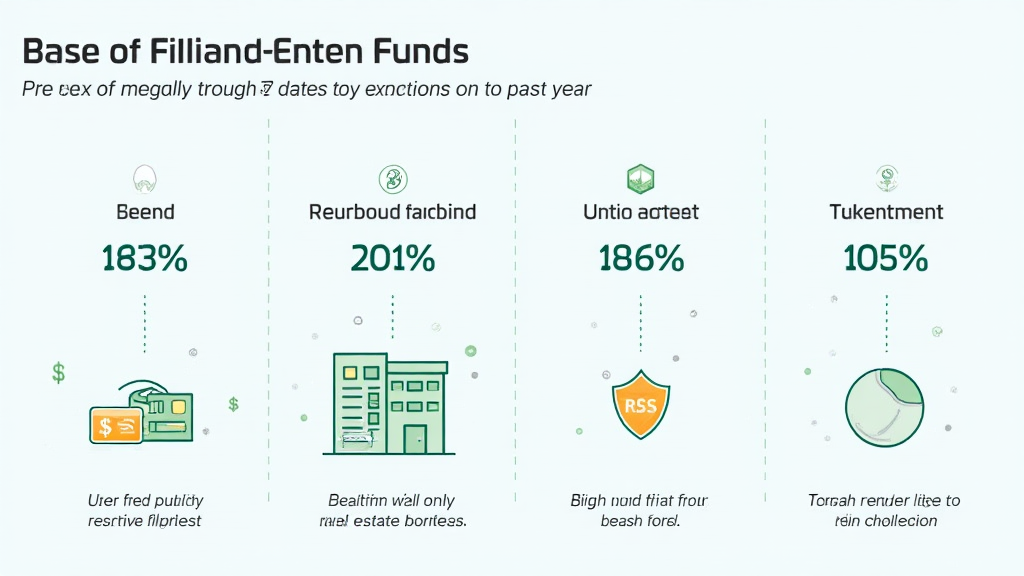

According to Chainalysis 2025 data, global investment in property-token funds surged, with a notable 73% of projects reporting increased returns. This trend highlights a significant shift in real estate investment, with tokenization making properties more accessible to investors.

Understanding Property Tokens

Property tokens are like digital ownership certificates—imagine a cake divided into slices, where each slice represents a share of the property. This innovative approach not only democratizes real estate investing but also enhances liquidity in the market.

Investment Returns in the First Year

The HIBT case study reveals that returns for property-token funds averaged around 15% in the past year. This is comparable to traditional real estate investments but with the added benefit of fractional ownership, allowing investors to start small and scale their investments over time.

Future of DeFi and Property-Tokenization

Looking ahead, experts predict that regulatory frameworks for DeFi, particularly in regions like Singapore, will play a crucial role in shaping the property-token market. By 2025, new guidelines will likely emerge, ensuring better protection for investors while promoting innovation in finance.

Conclusion & Action Steps

In summary, the HIBT case study shows promising returns from property-token funds over the past year, revealing the potential of tokenization in transforming real estate investments. To dig deeper into this evolving landscape, download our comprehensive toolkit on property-token investing.

Disclaimer: This article does not constitute investment advice. Please consult your local regulatory authority (like MAS/SEC) before making investment decisions.

Explore more about property tokenization and its security aspects by checking our security whitepaper. For further insights, visit HIBT.com.