Introduction to Hibt Stablecoins in Real Estate

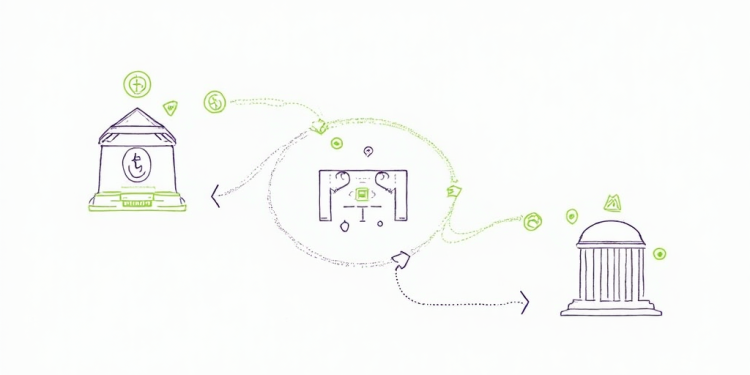

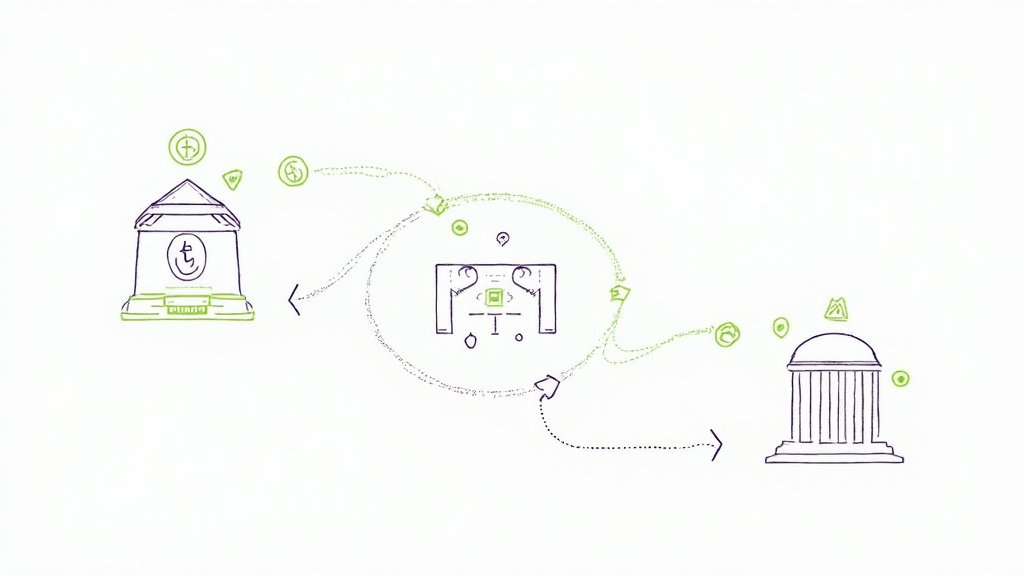

Recent Chainalysis data from 2025 highlights that a staggering 73% of cross-chain bridges currently have vulnerabilities, making secure transactions crucial in the evolving landscape of decentralized finance. One major update is the integration of Hibt stablecoins for real estate purchases, significantly aiming to bridge this gap.

Understanding Hibt Stablecoins

Hibt stablecoins can be likened to a standardized currency in a local market—everyone knows its value, similar to how local vendors rely on consistent currency for purchases. With Hibt, buyers and sellers in real estate transactions can ensure that the price remains stable, minimizing fluctuations common in other cryptocurrencies.

The Benefits of Hibt Stablecoin Integration

Integrating Hibt for real estate transactions provides multiple advantages. Firstly, transaction speeds are significantly increased compared to traditional methods, akin to how a fast-food drive-thru beats dining in a restaurant. Additionally, the lower transaction fees can be vital for buyers and sellers, resulting in better investment returns.

Real-World Applications and Regional Focus

Particularly in regions like Dubai, where digital currency regulations are on the rise, the Hibt stablecoin is poised to simplify property purchases. Investors might find that utilizing Hibt not only meets local regulatory standards but also provides a clear path toward using blockchain tech within real estate, much like utilizing a GPS to navigate unfamiliar territory.

Conclusion

In summary, the Hibt stablecoin integration is a significant step forward in the realm of real estate purchases, addressing both security concerns and transactional efficiency. For detailed insights, download our comprehensive toolkit and stay ahead in your investments.