Introduction

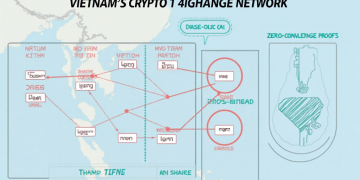

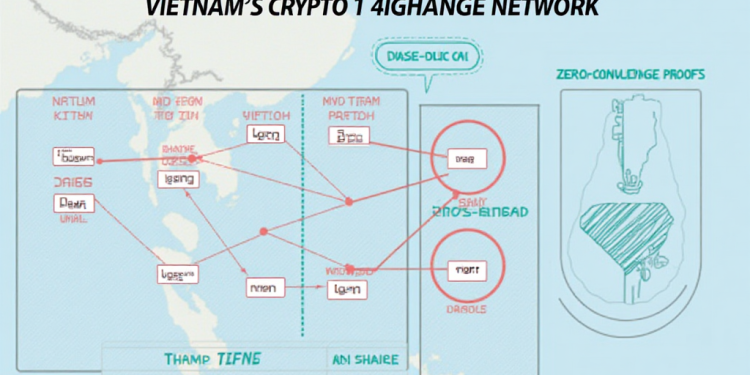

According to Chainalysis 2025 data, a staggering 73% of cross-chain bridges globally exhibit vulnerabilities, raising alarms about security in the crypto space. As Vietnam’s crypto exchange market continues to expand, understanding network segmentation becomes crucial for ensuring resilience against these risks.

Understanding Network Segmentation in Crypto Exchanges

Think of a crypto exchange like a bustling market. Just as different stalls sell various goods, network segmentation separates different digital assets into distinct areas. This system enhances security by preventing unauthorized access, similar to how a vendor might keep their cash register segregated from foot traffic.

The Role of Cross-Chain Interoperability

Cross-chain interoperability allows different blockchain networks to communicate. It’s like having a translator at the market, enabling customers to interact smoothly between stalls. However, not all translations are perfect. In Vietnam, the focus is on finding solutions to ensure smooth transactions while prioritizing security, thus addressing the critical issue of network segmentation in crypto exchanges.

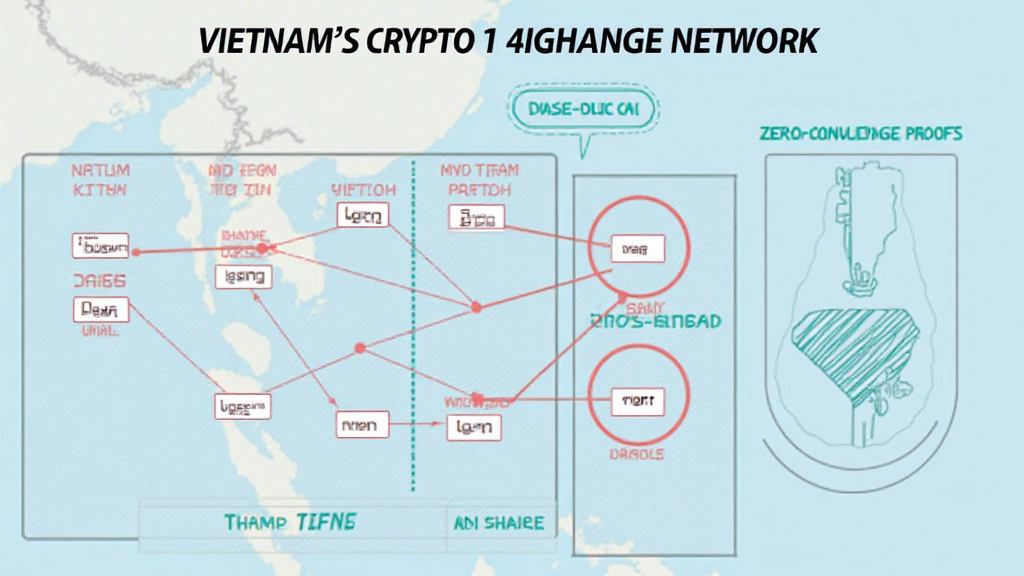

Zero-Knowledge Proofs: A Security Game-Changer

Imagine buying a basket of fruits: you don’t need the vendor to know your entire identity, just that you can pay. Zero-knowledge proofs (ZKPs) function similarly. They allow users to prove their identity or assets without revealing sensitive information. For Vietnam’s crypto exchanges, implementing ZKPs can significantly bolster user privacy and trust.

Future Outlook: Regulatory Trends in Vietnam’s Crypto Market

As we look towards 2025, Vietnam is expected to align its regulatory framework with international standards. This shift aims to enhance transparency and security in crypto exchanges. Just like the local markets adapting to consumer behavior, the crypto landscape in Vietnam will evolve through proactive measures, assuring users of a safe trading environment.

Conclusion

In summary, understanding Vietnam crypto exchange network segmentation is vital for mitigating risks and ensuring a robust trading experience. As the market adapts and grows, leveraging tools like Ledger Nano X can reduce the risk of private key exposure by up to 70%. Download our comprehensive toolkit now to stay ahead in the evolving crypto landscape!

Check out our cross-chain security white paper and stay informed on regulatory updates that could affect your crypto endeavors.

Disclaimer: This article does not constitute investment advice. Always consult local regulatory agencies like MAS or SEC before making any investment decisions.