2025 Vietnam Crypto Exchange Geographical Coverage Insights

In 2023, Chainalysis reported that approximately 73% of crypto exchanges globally are vulnerable to various security threats. This alarming statistic underscores the importance of evaluating the geographical coverage and security features of crypto exchanges in Vietnam.

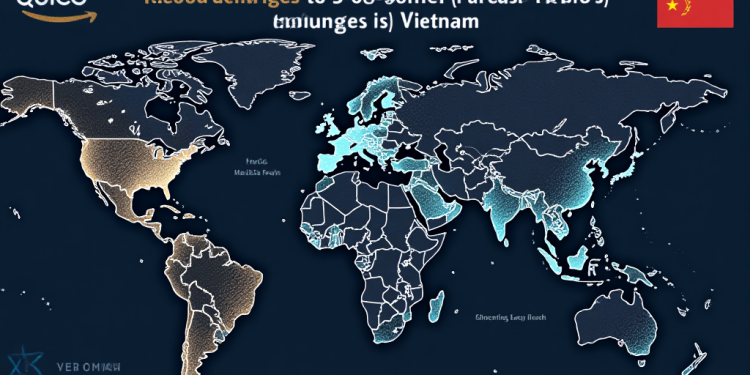

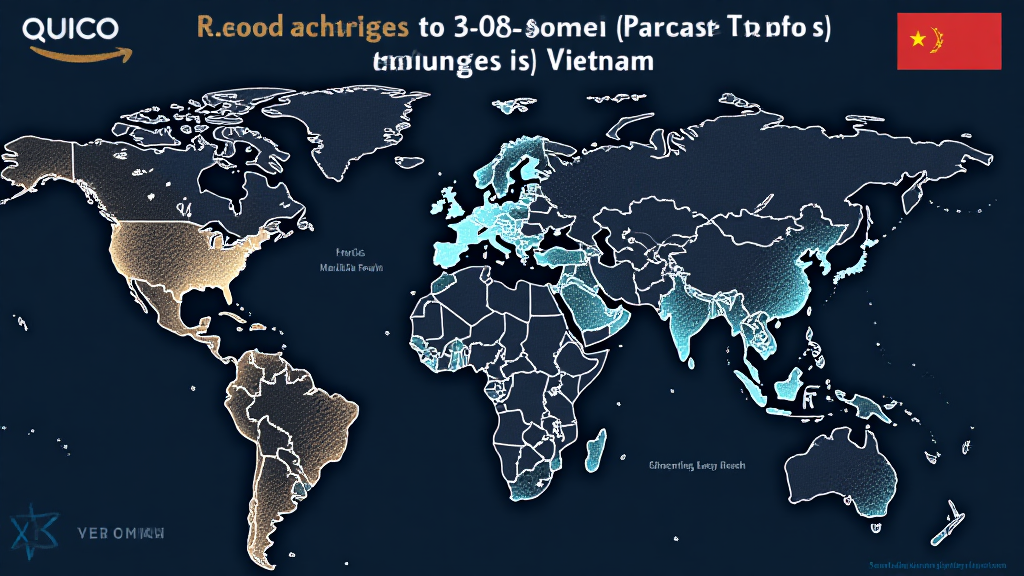

Understanding the Geographical Coverage of Vietnamese Crypto Exchanges

Imagine a market where each stall represents a different vendor. Some vendors only serve their local area, while others reach customers far and wide. Similarly, crypto exchanges in Vietnam vary in their geographical coverage. While some cater exclusively to local traders, others have global reach. For instance, platforms like Binance have entrenched their operations firmly in Vietnam, whereas smaller exchanges focus only on local transactions.

The Role of Cross-Chain Interoperability

Cross-chain interoperability is like a universal translator for crypto exchanges—it allows different blockchain networks to communicate. This could mean that a Vietnamese crypto exchange could facilitate transactions not just in VND but across various international markets. Consider this: if you’ve managed to buy a rare fruit from a seller not in your neighborhood, you’ve experienced the benefits of good communication between vendors. In the context of crypto, this could enhance liquidity and trading opportunities.

Zero-Knowledge Proofs and Their Applicability

Think of zero-knowledge proofs (ZKPs) as a way to authenticate yourself without revealing personal information. For Vietnamese crypto traders, this technology can enhance security and privacy when making transactions. As implemented in platforms like Zcash, ZKPs allow for secure transactions that maintain user confidentiality, addressing growing concerns about data security in crypto exchange operations.

Local Regulations Impacting the Landscape

Local regulations serve as the framework or rules of the game for crypto exchanges. Just as different countries have varied traffic laws, they also have differing rules on cryptocurrency. The evolving DeFi regulatory trends in Vietnam signify the government’s acknowledgment of the growing crypto ecosystem and its need for structured legal guidance. According to CoinGecko’s 2025 data, a regulated environment could enhance investor confidence and attract more participants.

In conclusion, understanding the geographical coverage and the new technologies being integrated into Vietnam’s crypto exchanges is crucial for traders and investors. As the landscape evolves, stay informed about developments by downloading our comprehensive toolkit that includes a guide on crypto regulations in Vietnam. For further insights, check out our crypto security whitepaper.

Disclaimer: This article does not constitute investment advice. Always consult your local regulatory authority before making financial decisions.

Tools: To secure your crypto assets, consider using a Ledger Nano X, which can reduce your private key exposure risk by up to 70%.