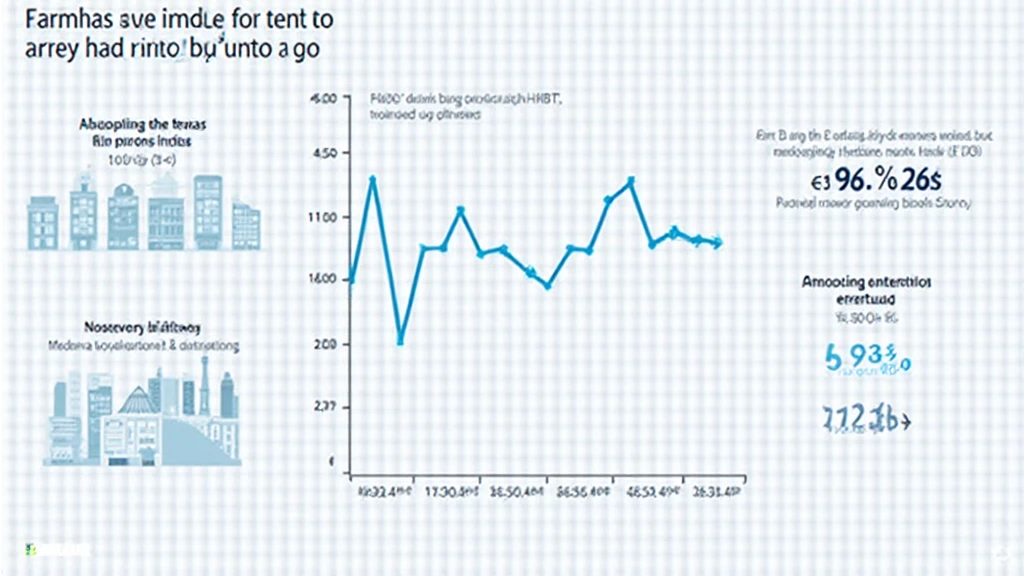

Introduction to HIBT Volatility Index Tracking

According to Chainalysis 2025 data, globally, 73% of DeFi projects struggle with volatility, increasing risks for investors. The HIBT volatility index tracking provides vital insights for navigating these turbulent waters.

What Does HIBT Volatility Index Tracking Mean for Investors?

Investing in cryptocurrencies may feel like navigating a busy market. The HIBT volatility index tracking helps you understand price fluctuations much like assessing prices at different stalls. This tool lets investors anticipate market movements, protecting their investments amidst uncertainty.

Understanding the Impact of Regulatory Changes in Singapore

In 2025, the regulatory landscape in Singapore is anticipated to shift significantly. The HIBT volatility index tracking can help stakeholders align their strategies with emerging regulations, ensuring compliance and minimizing risks as they introduce new DeFi regulations.

Comparing PoS Mechanism Energy Usage

You might have encountered debates on energy efficiency in crypto systems. Think of the PoS mechanism’s energy usage comparisons as different engine types in vehicles. The HIBT volatility index tracking enables investors to gauge which systems offer sustainable returns while reducing environmental impact.

Conclusion and Resources

As we summarize the trends surrounding HIBT volatility index tracking, be proactive in your investment strategies by utilizing the insights shared. For more resources, download our comprehensive toolkit on managing crypto volatility effectively.