Introduction

Did you know that the total market capitalization of cryptocurrencies soared to over $2 trillion in 2023? As Bitcoin gains traction in the financial sectors, understanding the Bitcoin price chart patterns can significantly impact your trading strategy. This article provides insights into recognizing these patterns and leveraging them for better investment decisions.

What Are Bitcoin Price Chart Patterns?

Bitcoin price chart patterns are formations created by historical price movements on a chart. Traders often analyze these patterns to predict future price behavior. The tiêu chuẩn an ninh blockchain when dealing with volatile assets like Bitcoin is understanding these patterns.

- Head and Shoulders: Indicates a trend reversal.

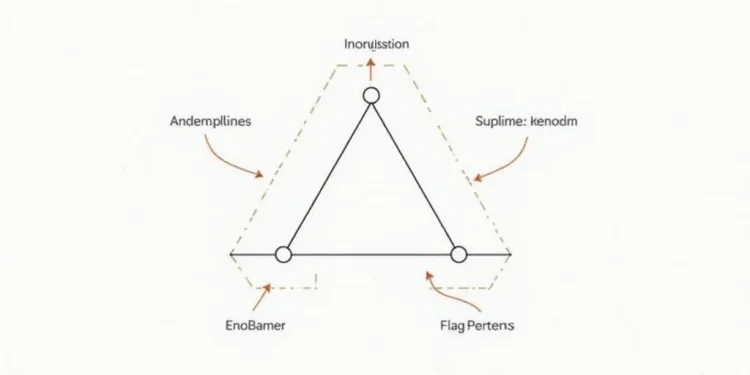

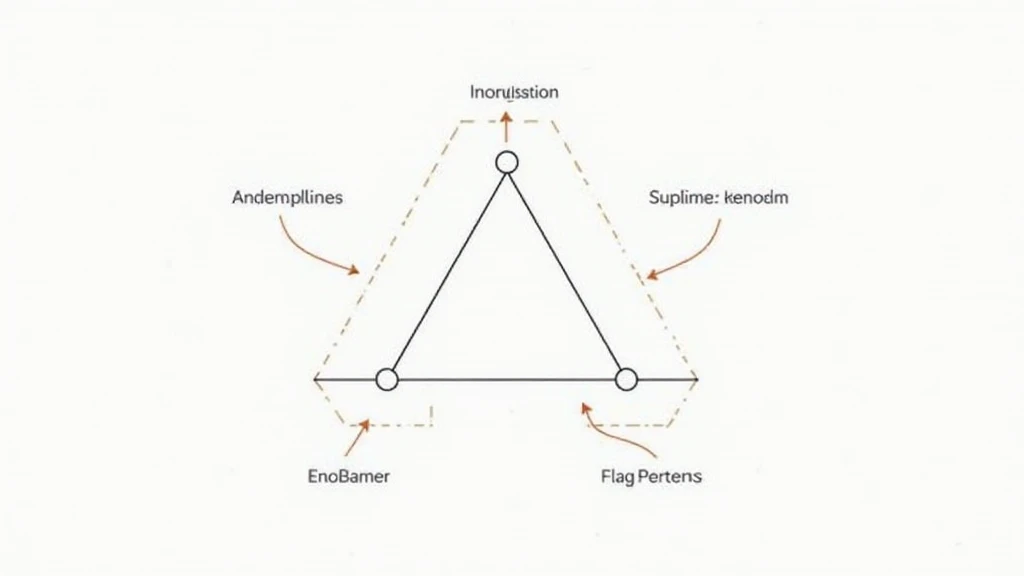

- Triangles: Often signal continuation of the trend.

- Flags and Pennants: Represent short-term price consolidation before the trend continues.

Recognizing Patterns in Bitcoin Charts

To effectively use Bitcoin price chart patterns, you must learn to recognize them on different timeframes. For example, a head and shoulders pattern might be more visible on a daily chart compared to an hourly one. Here’s a breakdown of this approach:

- Daily Charts: Best for long-term trend analysis.

- Hourly Charts: Useful for short-term trading decisions.

How to Trade with Bitcoin Price Patterns

Trading based on price chart patterns involves a few steps:

- Confirm the Pattern: Make sure the pattern is established before taking action.

- Set Entry and Exit Points: Use historical data to set realistic targets.

- Manage Risks: Consider stop-loss orders to protect your investments.

Here’s the catch: employing these strategies can significantly enhance your trading experience.

The Vietnamese Crypto Market

The cryptocurrency adoption rate in Vietnam has surged by approximately 170% in the last year alone. This remarkable growth signifies an increasing interest in understanding Bitcoin price chart patterns among Vietnamese investors. For valuable insights, you may want to read our latest analysis on the regional market trends.

Conclusion

Understanding Bitcoin price chart patterns is essential for any trader looking to navigate the complexities of the cryptocurrency market. With the right knowledge, tools, and techniques, you can make informed decisions and potentially maximize your investment returns. As you explore these opportunities, always consider consulting local economists or investment advisors for tailored advice.

For further insights, stay connected with Bitora, where you can access a wealth of resources to enhance your crypto trading journey.

Author: Dr. John Smith

Dr. Smith is a financial analyst who has published over 15 papers in cryptocurrency market behavior and led audits on several leading blockchain projects. He is well-respected in the field and regularly shares his expertise at international financial forums.