Understanding Bitcoin Price Fluctuations

Bitcoin has seen significant price fluctuations since its inception in 2009. In fact, according to CoinMarketCap, Bitcoin’s price reached an all-time high of nearly $64,000 in April 2021, followed by a significant dip to below $30,000 in mid-2022. But what drives these changes? Factors such as market sentiment, regulatory news, and macroeconomic conditions all contribute. As of 2023, Bitcoin remains volatile, making historical trends crucial for investors.

The Impact of Major Events on Bitcoin Prices

Major events like the introduction of new regulations or technological advancements often spark noticeable impacts on Bitcoin prices. For example, when El Salvador adopted Bitcoin as legal tender in 2021, the market witnessed a rally. Conversely, when China cracked down on cryptocurrency transactions, the price dropped significantly. Such trends highlight the importance of being aware of global news.

Localizing the Bitcoin Market: The Case of Vietnam

Vietnam is witnessing a surge in cryptocurrency adoption, with over 5 million crypto users by 2023, according to Statista. The growth rate in users has increased by 30% year-over-year. This is a clear indication that more people in Vietnam are interested in understanding Bitcoin price historical trends. The Vietnamese market responds quickly to Bitcoin’s fluctuations, presenting unique opportunities and risks.

Moreover, tiêu chuẩn an ninh blockchain is becoming more relevant as local exchanges implement more robust security measures.

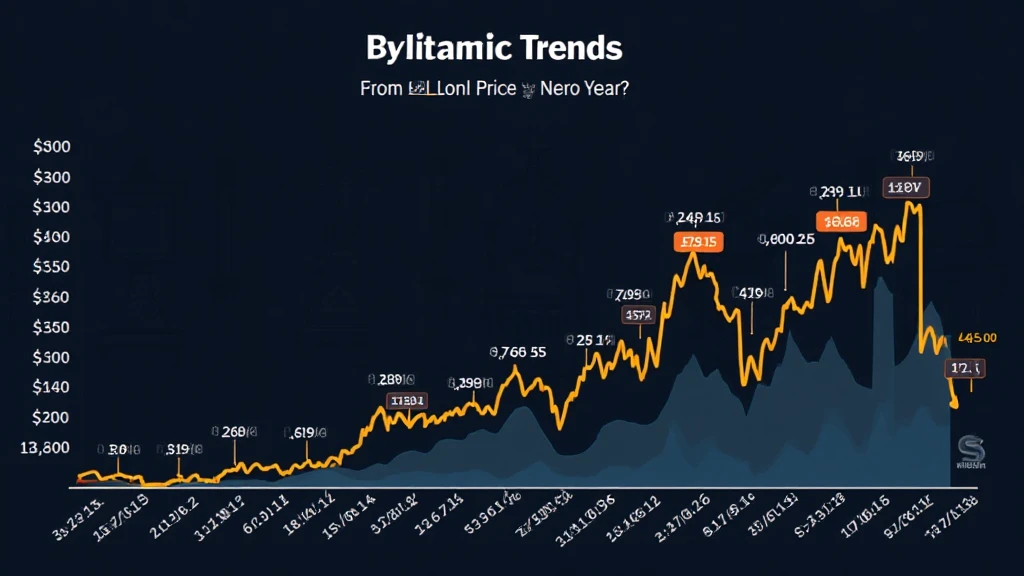

Analyzing Historical Bitcoin Price Charts

To fully appreciate Bitcoin’s price trends, it’s beneficial to analyze historical charts. For instance, during the 2017 bull run, Bitcoin’s price surged from around $1,000 at the beginning of the year to nearly $20,000 by December. This increase was fueled by retail investor excitement and media coverage. By studying these past trends, investors can gauge potential future movements and strategize accordingly.

Key Takeaways for Investors

- Understanding historical trends is vital for making informed investments.

- Stay updated with global events that can affect Bitcoin prices.

- Local market dynamics, especially in regions like Vietnam, contribute to price movements.

- Utilize tools, like cryptocurrency analytical platforms, to track ongoing trends effectively.

As you dive deeper into the realm of Bitcoin investment, keeping an eye on historical trends will not only boost your understanding but also prepare you for future uncertainties in the market. Let’s not forget to consult local financial advisors for personalized strategies. For more on cryptocurrencies and their implications, visit hibt.com.

In conclusion, recognizing Bitcoin price historical trends is essential whether you are a beginner or a seasoned investor. By staying informed about market dynamics, especially in rapidly growing markets like Vietnam, you will be better equipped to navigate the crypto landscape. Remember to consider each price point within the broader context of historical performance.

Written by Dr. Alex Nguyen, a renowned blockchain analyst with over 15 published papers in cryptocurrency and digital asset security. He has led audits for several well-known projects in the industry.