Introduction

In 2024, an astounding $4.1 billion was lost due to hacks in decentralized finance (DeFi). As the staking derivatives market rapidly grows, understanding the various platforms is essential for investors looking to safeguard their assets and maximize returns. This article aims to provide a comprehensive overview and comparison of staking derivatives platforms, highlighting their unique features, challenges, and suitability for different user needs.

Understanding Staking Derivatives

Staking derivatives offer a unique way for cryptocurrency holders to earn rewards by delegating their assets to validators while maintaining liquidity. Unlike traditional staking, staking derivatives allow users to trade the derivative tokens, which represent their staked assets.

For instance, consider this comparison: Imagine a bank that lets you earn interest on your savings while providing a debit card for purchases. This is akin to staking derivatives, where you can earn yield and still use your assets.

Key Features of Popular Staking Derivatives Platforms

- Decentralization: Platforms like Lido and Rocket Pool prioritize decentralization, enabling user participation in governance.

- Yield Rates: Yearn Finance offers competitive yield rates that attract DeFi users seeking optimal returns.

- Liquidity Options: Staked tokens can often be redeemed or traded, providing flexibility that standard staking does not.

Challenges in Staking Derivatives

While staking derivatives come with numerous benefits, they also have particular challenges:

- Smart Contract Risks: As with any blockchain application, vulnerabilities can exist. Staying informed about how to audit smart contracts is crucial for safety.

- Market Volatility: The value of staked tokens can fluctuate, affecting potential returns.

- Regulatory Concerns: Regions like Vietnam are seeing increased regulation in the crypto space; for instance, the Vietnam user growth rate for crypto is expected to accelerate further, leading to a demand for compliant solutions.

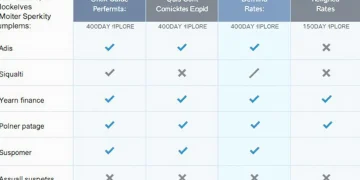

Comparing Leading Staking Derivatives Platforms

| Platform | Yield Rate | Liquidity | Security Features |

|---|---|---|---|

| Lido | Up to 7% | High | Multi-signature wallets |

| Rocket Pool | Around 6% | Moderate | Decentralized node operators |

| Yearn Finance | Varies per strategy | High | Smart contract audits |

According to recent data from Chainalysis, the staking derivatives market is projected to grow significantly, attracting more users in 2025.

Conclusion

In summary, choosing the right staking derivatives platform is essential for optimizing your investment and minimizing risks. While platforms like Lido, Rocket Pool, and Yearn Finance offer unique advantages, understanding the associated risks, including tiêu chuẩn an ninh blockchain, is key. As Vietnam continues to embrace the crypto economy, now could be a perfect time to explore your options. For more insights, visit hibt.com.