Understanding Tokenized Carbon Credits

Have you ever wondered how tokenized carbon credit trading platforms could revolutionize the way we approach sustainability? According to recent data, carbon credit trading could reduce global emissions by over 1 billion tons by 2025. But what does this mean in practical terms?

How Do Tokenized Carbon Credit Trading Platforms Work?

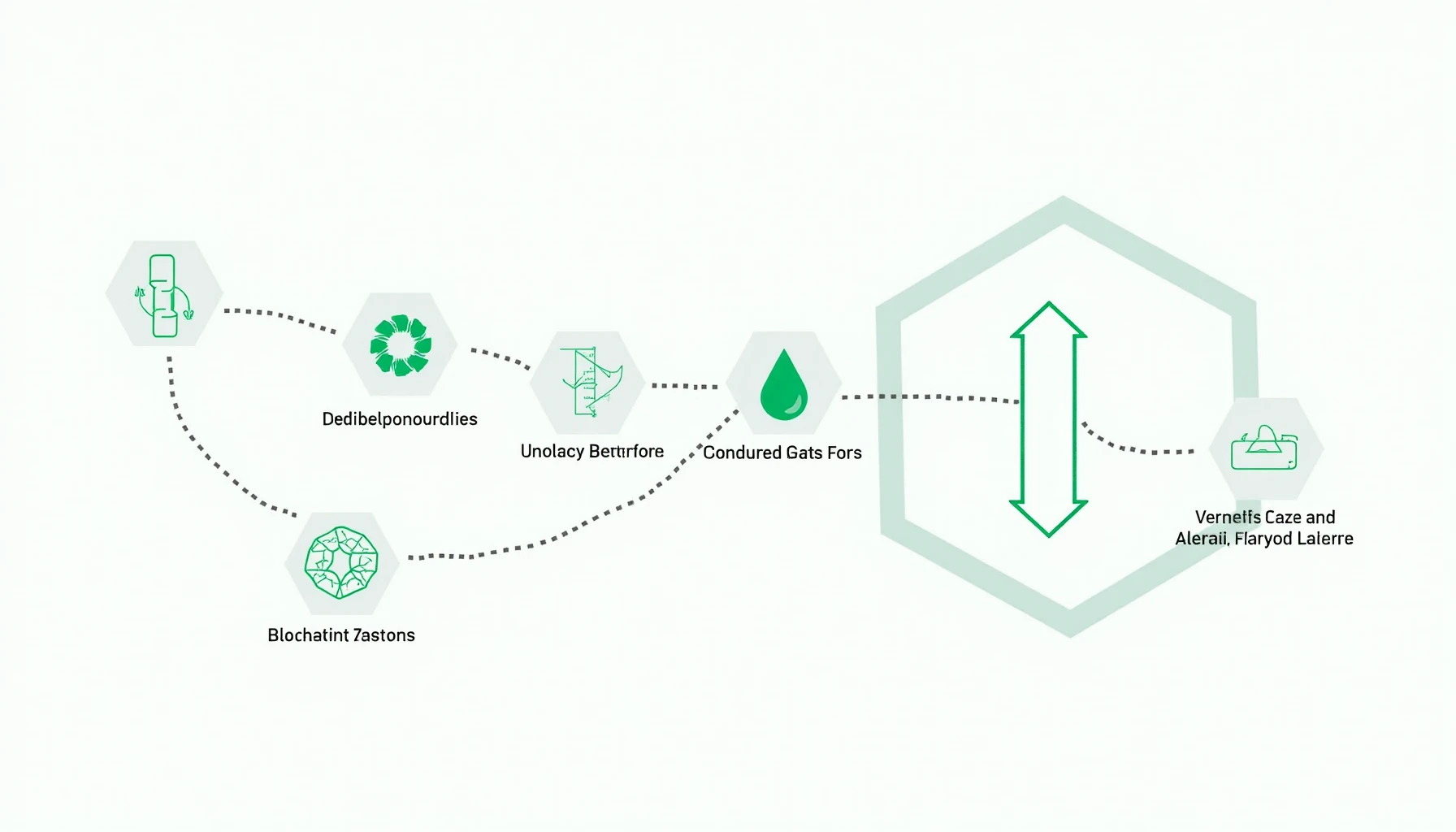

Think of a tokenized carbon credit as a digital equivalent of a carbon offset. Each token represents a reduction of one ton of CO2 emissions. These platforms operate on blockchain technology, ensuring transparency and traceability of transactions. Here are some key features:

- Decentralization: No single authority governs the trading, enabling peer-to-peer transactions.

- Smart Contracts: Automate the processes involved in trading, ensuring compliance and reducing administrative costs.

- Low Barriers to Entry: Even individuals can participate, democratizing access to carbon markets.

Benefits of Using Tokenized Platforms

Switching to a tokenized solution offers several advantages:

- Enhanced Liquidity: Tokenization can make carbon credits more liquid, allowing for easier buying and selling.

- Global Accessibility: Users from regions like Singapore can trade carbon credits online.

- Market Efficiency: Increased competition can lower prices for carbon credits, benefiting all participants.

Challenges and Considerations

While the prospects are exciting, consider these challenges:

- Regulatory Compliance: The tokenized markets must adhere to evolving local regulations.

- Technical Knowledge: New users may find it daunting. For example, understanding how to set up a digital wallet can seem complex at first.

Conclusion: The Future of Carbon Credit Trading

As we move towards 2025, the potential for growth in tokenized carbon credit trading platforms looks promising. These tools not only combat climate change but also open new avenues for digital currency trading. So why wait? Start exploring carbon credit trading today and contribute to a sustainable future!